What is the first instrument which comes to your mind when you want to create your financial portfolio? Is it a mutual fund scheme, shares and stocks or the more conservative bank fixed deposits? What about a term insurance plan? Does it ever feature anywhere in your ‘to buy’ list?

When it comes to life insurance, we all have a tendency to ignore it. Blame it either on the lack of awareness or the biased perception, a life insurance policy is usually given a miss. When it comes to a term insurance plan, the situation worsens. Since term plans usually pay only death benefit, our aversion increases. We start questioning: What about the return on our investments? Let me highlight the various returns of a term insurance for you:

The returns provided by a term insurance plan far outweigh the monetary gains provided by other investment avenues. Here are the top reasons, which make a term insurance plan an absolute buy:

A contingency fund for your family.

Whom does your family depend on for meeting their lifestyle expenses? If you are the sole bread-winner, it would be you and your earnings. What would happen in case of your premature death? How would your family cope with their expenses? A term insurance plan comes to your rescue here. Since the plan pays a lump sum benefit on premature death, your family gets the much-needed financial assistance. The benefit received from the plan can be used for meeting the daily expenses and other financial obligations of your family. Thus, a term insurance plan helps in creating a contingency fund for your family in your absence.

Read on why life insurance should be bought early.

Gives you peace of mind.

Wise men say peace of mind is the best return and a term insurance plan gives you just that. By enabling you build up a contingency fund, a term plan assures peace of mind. You can relax knowing that even in case of any unforeseen eventuality (read premature death) your family would be financially secured.

High coverage at cheapest premiums

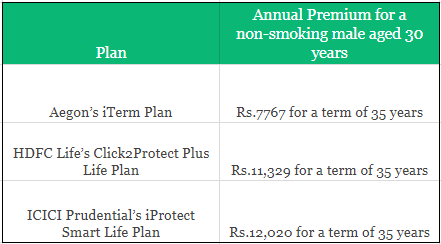

Considering the rising expenses in modern times, an optimal contingency fund is required for a complete financial security. Affording such a fund is possible only with a term insurance plan. In fact, the USP of term plans is the coverage level vis-à-vis the premium charged. You can avail high coverage at very low premiums through a term insurance plan. Don’t believe me? Here’s a look at the premiums of three popular term insurance plans for coverage of Rs.1 crore:

Would you get such value for money anywhere else?

Protection against debt liability

Decreasing term plans are designed to take care of our loans and mortgages. Under these plans, the Sum Assured and the plan term are selected to reflect the loan amount, the interest rate and the loan repayment tenure. Every year, the Sum Assured decreases by a certain percentage (depending on the plan). The resultant Sum Assured (after every decrease) reflects the outstanding amount of loan. In case of early death, the plan pays the Sum Assured as in the year of death to repay the outstanding loan. Thus, your family is spared the burden of your debt. Decreasing term plans, therefore, are also called mortgage redemption plans.

Low claim rejections

Ideally, you should fill up the plan’s proposal form. If you do so and provide the relevant details correctly, the chances of your claim’s rejection become nil. You get assured claims if you furnish correct details. Moreover, courtesy of the Insurance Amendment Act 2015, any claims made after the first 3 policy years are compulsorily honored by the insurance company. So, your wish for your family’s security would not remain unfulfilled as your term insurance claims would be honored.

Thus, given all the above returns, a term insurance plan is an essential investment. It should feature in your financial portfolio. Given the plan benefits and the advantages, peace of mind being the primary one, how can you avoid it? So, stop ignoring a term plan and buy a term insurance plan at the earliest.

Read more about What is insurance and how does it work?

Read more about Common terms in life insurance policies

Read more about Life insurance policy in India – How does it works?

Do you know some insurance companies offer term plans upto 99 years? Check out our video to know more

Feel free to share your comments below.