A term insurance policy is the most basic form of insurance which covers the risk of premature death. The policy provides financial security to the family if the insured dies during the policy tenure. The policy allows the policyholder to afford a high sum assured because the premiums are low. This high sum assured, therefore, allows the policyholder to arrange for a financial corpus sufficient enough for his family in case of his premature demise. The plan, therefore, helps in income replacement in case of death of the bread-winner.

A term insurance policy, therefore, is an important cover which should not be missed. Moreover, when buying the policy, a high sum assured should be chosen to ensure optimal security for your family in your absence. However, when you opt for a high sum assured, there is a requirement of a medical test for term insurance before the policy is issued.

Table of Contents

- When is the term insurance medical test needed?

- Why is a medical test for term insurance needed?

- What medical tests are required for term insurance?

The requirement of a medical test might discourage you from buying the term plan. However, such tests are beneficial both for you and the insurance company. Do you know when such a term insurance medical test is needed and why?

When is the term insurance medical test needed?

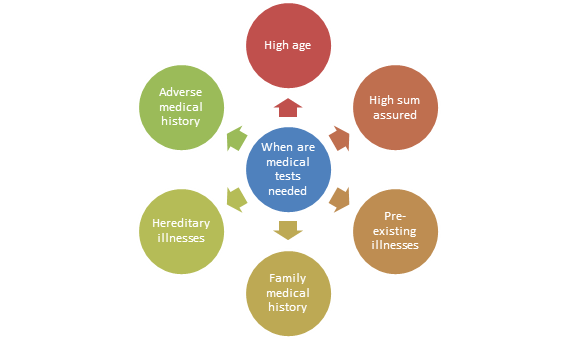

A medical test for term insurance coverage is needed in either or both of the following cases –

- You are aged more than 35 years

- You choose a sum assured of INR 10 lakhs and above

Some plans, however, do not require a medical test for term insurance for up to 40 or 45 years of age. Similarly, the sum assured limit is also relaxed for term insurance medical test requirements. Usually, coverage levels up to INR 20 or 25 lakhs are allowed without any medical tests if you are aged up to 45 years.

Moreover, if you have pre-existing illnesses, an adverse medical history, family history of diseases or hereditary conditions, the insurance company would require a medical test for term insurance even when you are young and/or you are choosing a low amount of sum assured.

The requirement of term insurance medical tests varies from plan to plan and depends on the underwriting policies of the insurance company. You should, therefore, check the medical grid of the insurance company to find out the age and sum assured when term insurance medical test is needed.

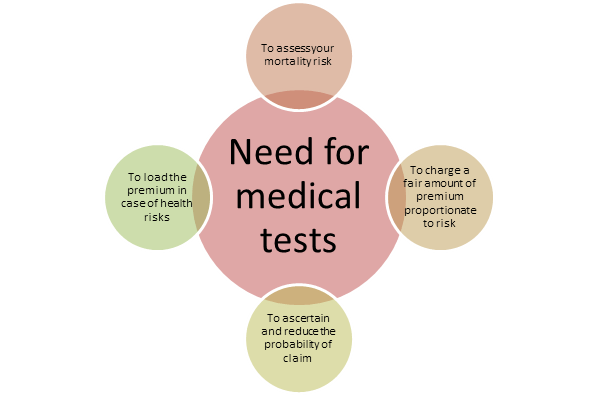

Why is a medical test for term insurance needed?

When you opt for a high sum assured and/or if you are in the older age bracket, the term insurance company undertakes a high risk in insuring you. In case of a claim a considerable amount would have to be paid which would put a dent in the company’s financial position. If the probability of claim is high, the company would make a loss as the sum assured would have to be paid in the early years of the policy itself. The company, therefore, wants to assess your health status to check whether you have any health condition which might increase the probability of claim. Through a term insurance medical test the company, therefore, checks your health condition. If you have any ailment which increases your chances of death, the company might increase the premium, restrict the sum assured or even reject the proposal for insurance. If, on the other hand, you have a normal health, the company would offer you the coverage without any added terms and conditions.

What medical tests are required for term insurance?

The medical tests to be done depend on the medical grid used by insurance companies. The range of tests required increases with age and sum assured opted. The first level of medical check-up is a routine medical exam which includes checking the following –

- Blood pressure

- Weight and height

- Routine Urine Analysis

- Complete Blood Count

- Lipid Profile

- Differential blood count

- Hemoglobin levels

- Fasting and Post Prandial blood sugar levels

- Electrocardiogram

Thereafter, as the age and/or the sum assured increases, the requirement of medical tests also increases. For higher ages and higher levels of sum assured, there are additional medical tests required besides the above-mentioned ones. These tests include treadmill test, EEG, etc. as specified in the insurance company’s medical grid.

Benefits of term insurance medical test

Though many individuals fear the pre-entrance medical check-ups needed before buying a term insurance policy, in reality, these medical tests are beneficial. Here are some reasons why –

- By undergoing a term insurance medical test, you can find out your health status yourself. You can, then, take preventive measures to maintain your health

- By choosing to undertake medical test for term insurance you can avail high coverage levels which would help provide optimal financial security to your family

- In case of a claim, if the death happens due to any medical reason, the insurance company would not be able to dispute the claim if medical tests were done before issuance of the policy. Term insurance medical tests, therefore, increase the chances of easy claim settlements.

- If your health is found to be normal in the medical tests, you would not have to pay hefty premiums to buy a term plan with a high sum assured.

Thus, medical tests are an important part of buying a high value term insurance plan and should be undertaken for best coverage.

How to buy the best term insurance policy?

If you are looking to buy the best term insurance policy, with or without medical tests, you can visit Turtlemint and compare between the available policies. Turtlemint is an online platform which is tied-up with leading life insurance companies offering some of the best term insurance plans. You can visit www.turtlemint.com and compare these policies on their coverage benefits, sum assured allowed and the premium charged. Thereafter, you can choose a policy which best fits your coverage needs, offers the most comprehensive scope of coverage and has the most reasonable premium rate. Once you shortlist the plan, you can buy it straight from Turtlemint’s website. The requirement of medical tests for term insurance would be arranged and communicated to you. Once the medical tests are done, the policy would be issued and you would be able to enjoy the coverage at the earliest. So, buy the best term plan online through Turtlemint’s website in some simple steps.

Frequently Asked Questions

1. Who bears the cost of term insurance medical tests?

Usually, the insurance company bears the cost of medical tests for term insurance plans. The company has a list of tied-up clinics wherein you can get yourself tested free of cost. However, if you undertake the medical tests in another clinic, you would have to bear the cost of such tests yourself.

2. If I have an unfavorable medical condition, would the policy be issued?

In case of unfavourable findings in the medical report, the issuance of the policy depends on the insurance company. If the finding is not very severe, for instance you have a slightly high blood sugar level or hypertension, the policy can be issued after loading the premium. In other cases, the insurance company might limit the amount of sum assured that you might avail. However, if the medical reports are severely adverse, the policy would not be issued and would be rejected.

3. Do I get the medical reports after I undergo pre-entrance medical tests for term insurance?

Usually, the clinic sends the medical reports directly to the insurance company based on which the insurance company issues the policy. If you want you can request the insurance company to issue you a duplicate of the medical report for your knowledge and the company would do that.

4. When does the medical test occur – before or after paying the premium?

A medical test is done after you fill up the proposal form and pay the premium for the policy. The company would, then, issue the policy only if the medical reports are satisfactory.

5. What happens to the premiums paid in advance if the proposal is rejected after medical tests?

If the insurance company rejects your proposal for insurance after the medical tests, the advance premium paid is refunded.