Understand their benefits and details

Life insurance companies not only offer insurance solutions for individuals but also for groups. Group life insurance plans are offered by almost all life insurance companies. Group insurance plans cover a group of individuals under a single plan. Let’s understand the concept of group life insurance in details –

What is group life insurance?

Group life insurance is an insurance policy on the life of the members of recognized groups. A single policy is issued which covers all the members who are a part of the group which is being insured. Usually, term insurance plans are offered as group life insurance plans and so group insurance plans are also called group term plans.

Salient features of group life insurance plans

Group life insurance plans have the following unique features –

A single policy is issued in the name of the group which is called the Master Policy. This Master Policy includes the names of all group members and provides coverage to all.

- A minimum number of members are required to buy group life insurance plans. Usually, this number is 25 but different plans might have a different minimum requirement of members.

- The policy is issued for one year after which it can be renewed for continued coverage.

- The sum assured is calculated based on the age of the members or their annual incomes or their level in a hierarchy.

- The premium can be paid by the group, its members or partially by the group and partially by the members.

- No medical underwriting is usually done for each member of the group. The insurance company underwrites the whole group as one based on the group’s composition and nature.

- Every member who is a part of the group gets covered under the plan.

- The premium, sum assured and the number of members covered might change on renewal of the policy. This happens because, after a year, the number of members might have changed. Moreover, the age of the members also increases by one year and so the coverage has to be revised.

- Riders can be taken with the term insurance cover for additional protection. There are two riders which are usually available. They are –

- Accidental death and disablement benefit rider which pays an additional sum assured in case of accidental death or disablement

- Critical illness rider which covers specified critical illnesses and pays a lump sum if the insured suffers from any of the covered illnesses.

If any rider is selected, the premium amount would increase.

- On renewal of the plan, if the claim experience of the group has been favourable, the insurance company offers discounts on the renewal premiums. A favourable claim experience means that the claim under the policy was low during the coverage year.

How do group life insurance plans work?

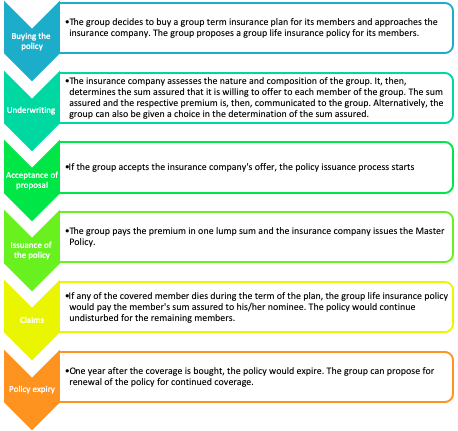

The following flowchart explains how group life insurance plans work –

Groups eligible to buy group life insurance

Eligible groups that can buy group term insurance plans include the following –

- Employer-employee groups

- Banks and their accountholders

- Clubs and their members

- Associations and their members

- Trade unions and their members

- Financial institutions and their customers

- Government and the citizen of India

Advantages of group life insurance schemes –

Group life insurance schemes provide various benefits to both the group and the group members. The benefits include the following –

- Group members can avail free life insurance coverage if the group is paying premiums for the group life insurance policy.

- The premiums of group life insurance plans are very low and affordable. In fact, the premiums prove to be lower than individual insurance plans making it easier to avail group life insurance.

- Since no medical underwriting is done separately for members of the group, coverage can be availed by members who are old or are otherwise unable to avail independent life insurance coverage for themselves.

- A group life insurance policy boosts morale among employees when their employer invests in an insurance plan on their lives. Employers can, therefore, benefit from increased morale and better employee retention.

- Group life insurance plans provide a lump sum benefit to the nominee of the covered member if the member dies during the policy tenure. This benefit helps the nominee deal with the financial loss suffered on the member’s death.

- Group life insurance plans also offer tax benefits. The employer can claim the premium paid as an admissible business expense under Section 37. If the employees are contributing towards their group life insurance premiums, the same can be claimed as a deduction under Section 80C up to INR 1.5 lakhs. Moreover, the death benefit received is also tax-free in the hands of the nominees.

- Every member joining the group gets the coverage of the group life insurance policy by virtue of his/her membership

- The coverage under group life insurance schemes is available worldwide. Even if the insured member dies in another country, the policy would cover the death and pay the death benefit.

Other types of group insurance plans:

There are other types of group insurance policies available in the market.

These include the following –

| Types of group insurance plans | Meaning |

| Group gratuity plans | These plans cover the gratuity payable by the employer after the employee leaves service after completing 5 working years |

| Group superannuation plans | These plans pay the pension payable to employees retiring from active employment |

| Group leave encashment plans | These plans cover the liability payable by the employer when the employee encashes his/her accumulated leaves |

| Group health plans | These plans provide health insurance coverage to the members of a group |

Group life insurance plans are a good way to provide insurance cover to multiple members of the group under a single policy. If you are also a part of a group, look for the coverage available in your group to enjoy affordable coverage without hassles.

FAQs

- Is the sum assured restricted under group insurance plans?

Yes, the sum assured is restricted under group life insurance plans. The sum assured is usually determined by the insurance company based on the age, income or position of the member in the group.

- How are premiums for group life insurance plans paid?

Premiums under group life insurance plans are paid in one lump sum by the group administrator buying the policy.

- Can a member join the policy mid-way?

Yes, if a new member joins a group midway during the coverage tenure, the member can be added to the policy coverage by paying an additional prorated premium for adding the member.

- Can minors be covered under group life insurance plans?

No, minors cannot be covered under group life insurance plans. The minimum coverage age is 18 years.