The recent Coronavirus pandemic has brought about unprecedented changes in the economy. With the lockdown extending to prevent the spread of the virus and the emphasis on social distancing, businesses are finding out new ways of operating. Even the Insurance Regulatory and Development Authority of India (IRDAI) has been issuing new guidelines for the insurance segment in the interests of the policyholders. All the guidelines are aimed to provide relief to the policyholders in their insurance policies. One such guideline issued by the IRDAI was the extension of the grace period allowed in paying life insurance premiums.

A relief, isn’t it? But do you know how long the extension is allowed for or what the grace period is exactly?

Grace period is a technical term used in the context of insurance policies but it is quite simple to understand. So, given below is the meaning of the grace period and the changes that IRDAI has proposed –

Table of Contents

- Grace period

- Duration of grace period

- IRDAI’s guideline on the extension of the grace period

- Reason for extending the grace period

- How does the guideline impact policyholders?

- How does the guideline impact insurance companies?

What is a grace period?

The grace period is an extension allowed under a life insurance policy to pay the premium beyond the premium payment date. During the grace period, the coverage does not stop. If the policyholder pays the premium within the grace period, the policy continues without any lapse. If the premium is not paid even within the grace period the policy would lapse.

Duration of grace period

In case of policies where premiums are paid annually, quarterly or half-yearly, the insurance company allows a period of 30 or 31 days (one month) as a grace period. For instance, suppose the premium payment date in a life insurance policy is 30th June. If premiums are paid annually, the policyholder would have until 30th July to pay the due premium. The period between 30th June and 30th July would be called a grace period wherein the coverage would continue. However, if premiums are not paid within the 30th of July, the policy will lapse on the 31st of July.

However, in policies where premiums are paid monthly, the grace period allowed is 15 days. So, if in the above example, the premiums were paid monthly, the grace period would be allowed till the 15th of July. From 16th July, the policy would lapse.

IRDAI’s guideline on the extension of the grace period

The Coronavirus pandemic resulted in a lockdown imposed by the Government on 25th March 2020. This lockdown restricted free movement and closure of businesses. Thus, policyholders whose life insurance policies were up for renewal in March found it difficult to pay the premiums due to the lockdown. Thus, keeping in mind the interest of the policyholders, IRDAI allowed an extension of the grace period allowed for premium payments. As per IRDAI’s new guideline, policyholders whose premiums were due in March 2020 can pay their life insurance premiums by 31st May 2020 and the policy would not lapse. Thus, the grace period allowed to policyholders has been extended till 31st May 2020.

Reason for extending the grace period

The sole reason behind IRDAI’s guideline to increase the grace period is to allow policyholders to renew their policies with ease. This is aimed to reduce lapsation allowing policyholders to enjoy uninterrupted coverage in their life insurance policies. If the lockdown has caused a financial crunch for individuals, they can plan their finances during the extended grace period and then pay the premium to keep their life insurance policies in force. Moreover, the extension of the grace period is also aimed at preventing policyholders from visiting the insurance company’s offices to renew their policies during the lockdown. IRDAI has asked insurance companies to offer online modes of premium payments to allow their customers to renew their policies online from the comfort of their own homes.

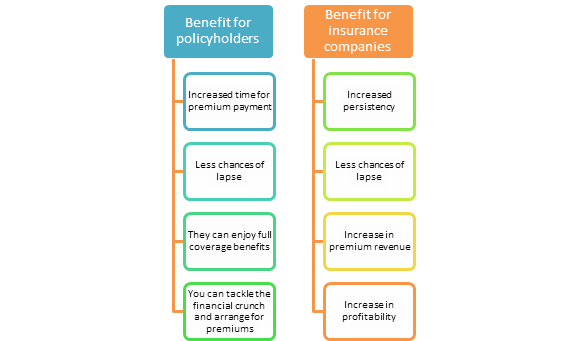

How does the guideline impact policyholders?

The IRDAI’s guideline is a welcome relief for policyholders who were worried about paying their life insurance premiums during the lockdown. For those of you who forgot the premium payment during April 2020, you can pay the premiums within the extended grace period and continue enjoying the full benefit of your policy. For those of you who had a financial crunch due to the lockdown, you can arrange for sufficient funds during the extended tenure to pay the premium and continue your policy without lapse. Thus, from the policyholders’ point of view, this extension is beneficial as it allows them to avoid captions.

How does the guideline impact insurance companies?

Even the insurance companies have welcomed this extension of the grace period as it means better persistence for them. Persistency is measured in terms of the policies that are in force at the end of the financial year compared to the total number of policies issued by the company. A higher persistency is favorable as it provides insurance companies with revenues in the form of premiums to meet their expenses and generate a profit. Since customers are allowed a longer grace period, the policies are less likely to lapse ensuring better premium collections for insurance companies.

Here’s a quick look as to how the new guideline is beneficial for both policyholders and insurance companies –

The IRDAI’s new guideline on the extension of the grace period, therefore, is beneficial for both policyholders and insurance companies. The measure was needed during this uncertain time of nationwide lockdown and it is expected that it would benefit the insurance segment.

Read more:

- Premium calculation of PLI and RPLI plans

- Download LIC Premium Payment Receipt

- Top Life Insurance Companies in India

Frequently Asked Questions

1. Does the extension of the grace period apply to health insurance policies as well?

No, this particular guideline is applicable only to life insurance policies. For health insurance policies, if the premium payment date fell between 25th March 2020 and 3rd May 2020, the grace period allowed is up to 15th May 2020. (Source: Economic times)

2. What would happen if the insured dies during this extended grace period without paying the due premium?

During the grace period, the coverage remains intact in a life insurance plan. Thus, if the insured dies during the extended grace period, the insurance company would pay the death benefit after deducting the premium amount that is due.

3. If I pay the premium within the extended grace period, would I be charged an additional interest?

No, payment of premium within the extended due date would not incur any additional interest payment. You would just have to pay the premium amount.

4. What would happen if the policy matures during the extended grace period and the premium is unpaid?

In case of maturity of the policy, the maturity benefit would be paid by the insurance company after deducting the premium that is due.

Found this post informational?

Browse Turtlemint Blogs to read interesting posts related to Health Insurance, Car Insurance, Bike Insurance, and Life Insurance. You can visit Turtlemint to Buy Insurance Online.