Insurance is an important aspect of everyone’s financial planning. Insurance is a contract that spreads the risk and provides protection against financial losses that may arise due to uncertainty. Insurance helps to achieve financial stability. Insurance is broadly categorized into two types – Life insurance and general insurance.

In this article, let’s learn the difference between life insurance and general insurance along with learning the types of plans offered under each of the two insurance categories.

Table of Contents

- Difference between LIC and GIC

- What is life insurance?

- Types of life insurance policies

- What is general insurance?

- Types of General Insurance

- Key things to consider while investing in an insurance plan

Comparison chart to know the difference between LIC and GIC:

| Basis of Comparison | Life insurance | General insurance |

| Meaning | Life insurance is an insurance contract, wherein the insurance company promises to compensate the insured individual for uncertainties of life that are death. Life insurance provides protection against life risk. | General insurance is an insurance contract, wherein the insurance company promises to compensate the insured individual or entity for the financial loss or damage caused due to an unfortunate event. General insurance gives protection for all the valuable things that are important to you. |

| Term of contract | Long-term contract | Short-term contract |

| Nature of contract | Life insurance is not a contract of indemnity. It is considered as an investment | General insurance is a contract of indemnity |

| Insurable interest | Life insurance requires the beneficiary to have an insurance interest in the person who is being insured. That means, insurable interest needs to be present at the time of underwriting | In general insurance policies, insurance interest is expected to exist both at the time of underwriting and at the time of loss. |

| Payment of claim | Benefits under the policy are paid on the occurrence of an insured event or on maturity | Financial loss caused due to the insured event is remembered on the occurrence of the particular event |

| Compensation value | The compensation value is dependent on the premium payable under the policy | The compensation value is the actual loss incurred in the insured event (maximum amount payable is subjected to the policy limit) |

| Premium payment | Premiums need to be paid periodically over the years for a specified term | Premium is paid in a lump sum as the policy is purchased for short-term and plans need to be renewed on expiry |

| Savings | Many life insurance plans come with a savings element which helps the insured to build corpus or create wealth for future | General insurance plans have no savings component as it’s an indemnity contract wherein you incur the premium cost to avail the protection |

Now that we know the difference between life insurance and general insurance, let’s understand both life insurance and general insurance in detail with the sub-categories offered.

What is life insurance?

Life insurance is a contract between two parties – insurance policyholder and insurance company, wherein the insurance company promises to pay a certain sum of money to the designated beneficiary in exchange for a premium during the demise of the policyholder.

A pure life insurance policy offers protection against life risk by providing death benefits to the beneficiary of the policyholder on his/her death.

However, life insurance plans come in a wider variety. Many life insurance policies come with dual benefit of protection and savings. There are plans that come with savings component attached. Let’s take a look at various types of life insurance plans available.

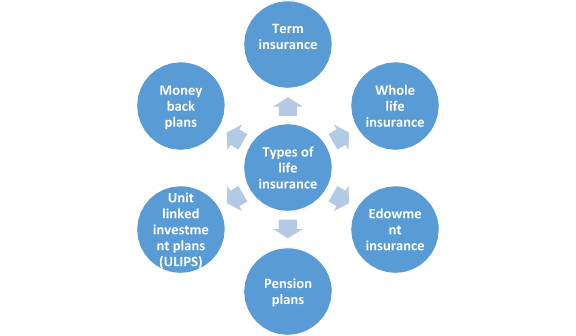

Types of life insurance policies

Term insurance:

Term life insurance plans are the pure protection plans that provide life cover for a specific term, say 20 years, 30 years and 40 years. Premiums under these policies need to be paid out periodically for the policy period. Sum assured or death benefit will be paid to the beneficiary if the insured dies during the policy term. If the insured survives the policy term, nothing will be paid in return as the policy has no savings component.

Whole life insurance:

As the name implies, whole life insurance plans are designed to provide risk cover as long as the policyholder is alive. Whole life insurance plans come with cash value component which will be paid as survival benefit at the end of the policy term/on maturity. However, even after the maturity of the policy, the plan continues to provide the death cover for the whole life of the insured.

Endowment insurance:

Endowment insurance policies are ideal for long-term investors looking for safe investment options. Endowment policies are the traditional products that come with a dual benefit of protection and savings. In these policies, if the policyholder dies during the policy term, the beneficiary will be compensated with death benefits. However, if the policyholder survives the policy period, lump sum (survival benefit) amount will be paid on maturity.

Money-back plans:

Money-back plans are the type of endowment plans that provide both protection and wealth creation benefits. But, in money back plans survival benefits are paid in proportions over the period of the policy term which helps to achieve major milestones in life.

Pension plans:

Pension plans are specially crafted investment products for post-retirement income. The premiums paid towards pension plans are accumulated and the lump sum benefit on the maturity is used to purchase an annuity for paying regular income then onwards.

Unit linked investment plans (ULIPs):

ULIPs are market-linked investment plus insurance plans that invest part of your premium in market-linked financial instruments and the part of your premium is used to provide life cover. ULIPs are the customizable products that come with multiple attractive features and flexible benefits.

What is general insurance?

General insurance is an indemnity contract that does not come under the purview of life insurance. Basically, general insurance provides protection against losses arising out of various risks to the important things you value such as health, business, motor vehicle and home. General insurance comes in various types.

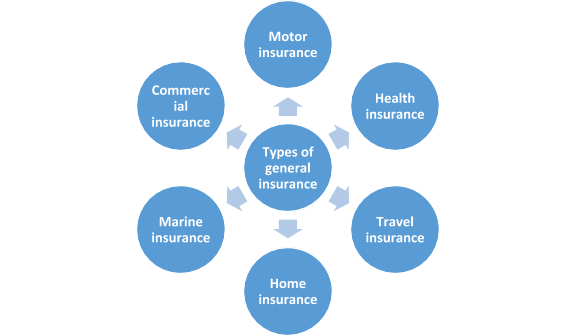

Types of General Insurance

Motor insurance:

Motor insurance provides protection against third party liability arising in an accident, damage to own vehicle due to man-made and natural calamities along with personal accident cover. The insurance can be availed for two-wheelers, four-wheelers and commercial vehicles.

Click on Car Insurance to know more about four-wheeler insurance plans and Bike Insurance to know more about two-wheeler insurance plans.

Health insurance:

Health insurance plans provide protection against expenses arising out of health contingencies.

Travel insurance:

Travel insurance provides coverage for medical emergencies and other trip-related losses such as trip cancellation, flight accident and lost luggage etc.

Home insurance:

Home insurance is property insurance that covers losses and damages to a home and assets in the home.

Marine insurance:

Marine insurance provides protection against losses or damages caused to ships, cargo and transport by which goods are transferred.

Commercial insurance:

Commercial insurance plans are designed to provide protection to businesses. There are various types of commercial insurance such as professional indemnity insurance, public liability insurance and employer’s liability insurance etc. which can be purchased depending on the requirement.

To conclude, life insurance and general insurance policies are required to secure our loved ones and the important things we love. Insurance provides you with peace of mind. Insurance is an effective way to manage risk.

Key things to consider while investing in an insurance plan

Deciding on investing in an insurance plan for the first time can be difficult; especially for someone who has just started earning and is not very clued up about how insurance works. Market research and advice from friends can help a lot. Here are some key things you can consider while doing your research before investing in an insurance plan:

- Your insurance needs: Before any research or advice, take a moment to think about your insurance needs. How much coverage will be good for you and your family? And, why do you need it in the first place? Any insurance agent or friend of yours can sell you dreams of the highest coverage, but do you need it? So, decide wisely.

- Coverage and premiums: After thinking about your needs you can explore and analyse different plans, their coverage and premiums. Turtlemint allows you to compare different plans and their benefits in detail. Take your time to make a decision and select a plan with premiums that you can manage.

- Add-ons along with premiums and benefits, you can also lookout for some add-ons in life insurance. Add-ons like disability and critical illness claims can be a good addition to a life insurance investment.

- The Company that you buy from. This is probably the most important aspect to consider. The company that you choose should be credible and trust-worthy. An insurance company’s claim settlement ratio is the number of claims they have insured out of the number of claims they have received in a year. Insurance companies with high claim settlement ratios are generally considered to be better to buy from. You can see the claim settlement ratios of companies on the internet. It is important to consider the company’s last year’s Claim settlement ratio if you are thinking of buying insurance from that company.

Read more:

Frequently Asked Questions (FAQs)

1. What are the tax implications of life insurance policies?

You can avail tax benefit on premiums paid for a life insurance policy. A tax deduction is allowed under Section 80C of the Income Tax Act, 1961 which allows exemption up to INR 1.5 lakhs for the year. Lump-sum benefits paid out by the life insurance policies are also exempt from income tax under Section 10 (10D) of the Income Tax Act, 1961.

2. How can I make premium payments for life insurance policies?

Premium payments can be made in various methods of life insurance policies. Following are the ways to make a premium payment

- Cheque/demand draft

- Online payment

- Standing instruction or ECS (Electronic Clearing System)

- Interactive Voice Response facility offered by the insurance company

3. What if I change my mind after purchasing the insurance policy? Can I cancel the insurance contract?

Yes. In most of the insurance policies ‘free look period’ is given wherein, you can go through the contract in detail and cancel the plan without any penalty if you are not satisfied with the terms and conditions of the policy with the reasons stated for rejection.

4. What is ‘claim’ in insurance policy?

The claim is nothing but placing a formal request to the insurance company to ask for compensation based on the terms and conditions of the policy. Once the claim request is placed, the insurance company will review and access based on the documents and information provided. Post verification, the claim will be approved and payment will be made.

5. What is indemnity insurance?

Indemnity insurance is a contractual agreement wherein the insurance company promises to compensate for the actual or potential losses and damages sustained by the policyholder in return of premium paid.

Found this post informational?

Browse Turtlemint Blogs to read interesting posts related to Health Insurance, Car Insurance, Bike Insurance, and Life Insurance. You can visit Turtlemint to Buy Insurance Online.