Financial planning – some say it is art while others boil it down to a series of steps. What is financial planning exactly- Art or science?

Financial planning is, in actuality, a mix of both. While there are definitive steps for making a successful financial plan, understanding the steps and applying it to your finances is an art. Until and unless you have a sound financial plan, you cannot make the most out of your finances. Do you have a sound financial plan?

Many don’t. If you are one among them, it’s time to make your plan. If, however, you do, you should review your plan. Whether you make a new plan or review an existing one, ask yourself the following questions to ensure that your financial plan ticks all the important features of a successful plan –

-

Have I done self-assessment?

Self-assessment is the first step in the financial planning process. Your personal finance should be understood by you. You should understand your finances in the context of your income, expenses and savings. Find out the assets you have and your liabilities. Determine your net financial worth which would complete the whole self-assessment process.

-

What are my financial goals?

After you have a clear picture of your finances, you would know the amount of your savings which can be invested. But the next question which you should ask is the purpose of your savings. The answer would, obviously, be that you are saving for your financial goals. But do you know your financial goals?

The next and the most obvious question in your financial planning process should be the identification of your financial goals. Find out why and when you would need money. Your goals can be child education, marriage of your children, buying a car or a house, taking a foreign vacation, planning for retirement, etc. Understand your life stage and know your financial goals.

-

What are the avenues of investment?

So you have figured out your disposable savings and the various goals towards which you have to save. The next logical step is finding out the various avenues of investments. Fortunately, when it comes to investment avenues, there is no shortage. You can choose from fixed income instruments, market-linked investment options, long-term options or short-term ones. The choice of the avenue should depend on the following factors –

- Your financial goals

- Investment horizon

- Tax implication of each avenue

- Your risk appetite

Each of your investments should be done after they qualify on these parameters. This would help you to avoid investing in unsuitable avenues.

-

Have I made a plan for unexpected contingencies?

Before you take the step of investing your money, stop and find out if you have planned for unexpected contingencies or not. Contingencies tend to sneak up on you when you least expect them to. As such, having a proper financial plan to deal with such contingencies is the wise thing to do. Insurance comes into the picture when you talk about contingencies. A life and a health insurance plan are quintessential requirements. While term insurance plans secure your family’s finances in case of your untimely demise, a health insurance plan takes care of unexpected medical costs. So, before you invest in any other avenue, invest in life and health insurance plans to plan for unexpected contingencies.

Read more about Health insurance not an options anymore but a necessity

Read more about 5 reasons why you need life insurance

-

Do I have sufficient emergency funds?

Another step to take before making goal-based investments is to have emergency funds. Emergency funds help you deal with unforeseen contingencies which are not dealt by insurance plans. For instance, if you lose your job or face a phase of loss in your business, you need funds to tide you over during the bad phase. Similarly, if you are hospitalised and your health plan does not pay for the accruing expenses, you need money to pay the bills. These contingencies demand an emergency fund. So, you should have an earmarked emergency fund which should also be sufficient. Now when it comes to sufficiency, there is a simple formula to ensure a decent size of the fund. As per financial experts, you should have at least 6 months’ worth of your income in a liquid emergency fund. So, first, create an emergency fund and, second, ensure that the fund is sufficient.

Find out How much India spends on out-of-pocket medical expenses

-

How can I create a diversified portfolio?

Now when you finally move to investing your funds, diversifying is important. You get two benefits from diversification. One, you get to spread the investment risk across different products. This helps in minimising the risk. Two, you get better returns. Wise men said don’t put all your eggs in one basket and diversification lets you avoid just that. So, choose different investment avenues and create a diversified portfolio. Invest in equity, debt, fixed-income instruments, long-term avenues and also short-term ones. You would be grateful for the benefits you get.

-

What should be my equity exposure?

Equity gives the maximum returns but is also very volatile. While it can make you rich quickly, one market slump and you lose everything. So, equity investment should be done with care. Ideally, your equity exposure should be determined by your age. As per a formula devised by experts, 100 minus your age would give you the ideal rate of equity exposure. So, if you are 30 years old, 70% of your investments should be in equity and if you are 50 years old, your equity investment should not be more than 50%.

-

Should I invest in property?

Real estate holds a lot of lure among many investors. Besides buying a house for residential purposes, people invest in property for rent income, for creating or simply to invest their surplus funds. While real estate investments are good, you should first make sure that all other financial goals have been met. If you have surplus, you can invest in property. However, if buying a house is a financial goal then investing in property is a good idea.

-

Am I getting enough liquidity from my investments?

Liquidity means easy availability of cash when you need. While many investment avenues promise easy liquidity, some don’t. For instance, if you have invested in property, liquidity is an issue. Similarly, fixed-term investment avenues also prohibit easy liquidity. Ideally, your portfolio should have both liquid and illiquid investments. While liquid investments would provide you funds when needed, illiquid ones would create a forced saving. So, don’t have a completely liquid or completely illiquid portfolio. Have sufficient liquidity without compromising on wealth maximisation.

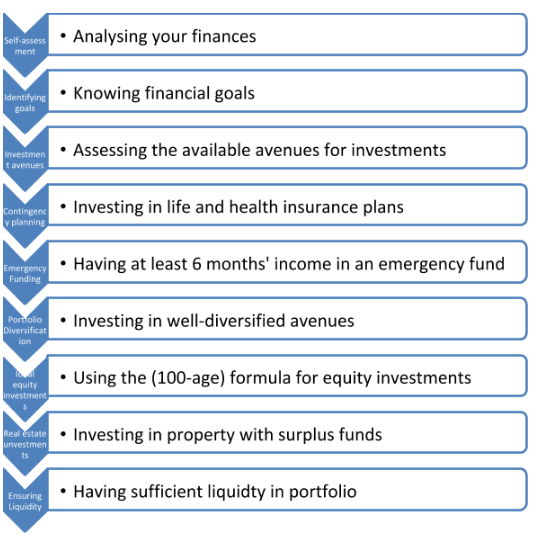

Once you get sufficient answers to these questions, you can create a successful financial portfolio. To sum up, here’s how your financial plan should proceed –

Use the flowchart, answer the questions and then plan your finances. You would be surprised with the efficiency of your plan.

Read more about What is Insurance and how does it work?

Read more about Should one buy health insurance plan or life insurance or both and when?