General insurance policies are those that cover non-life risks, i.e. risks not associated with life. They cover various types of financial risks that you might suffer in unexpected contingencies. There are different types of general insurance plans available in the market to cover the different types of risks that you face. All these plans cover the financial risks that you face and compensate you for the financial loss suffered. Some general insurance plans also give you tax benefits thereby helping you save taxes on your income.

Different types of general insurance plans in India

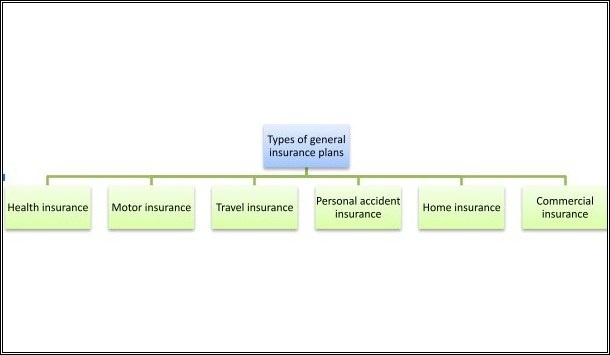

As mentioned earlier, there are different types of general insurance policies in India. These plans are as follows –

Furthermore, each type of general insurance policy is further subdivided into other types of plans. Let’s have a look at these plans in brief –

| Type of general insurance plan | Brief description |

| Health insurance | A policy that covers medical contingencies suffered due to an illness, injury or accident |

| Motor insurance | A policy that covers third party liabilities incurred if your vehicle damages third party property or causes third party injuries. Comprehensive motor insurance plans also cover the damages suffered by the vehicle itself |

| Travel insurance | A policy that covers the financial risks you might face when you are travelling for business, leisure or studies. Travel insurance plans cover both international and domestic trips |

| Personal accident insurance | A policy that covers accidental death and disablement. A lump sum benefit is paid in case of deaths or disablements suffered in an accident |

| Home insurance | A policy that covers the financial loss suffered due to damages caused to the structure and/or the contents of the house |

| Commercial insurance | A range of policies designed to cover the different types of risks that businesses face. Some example of commercial insurance policies include the following –

|

How to choose the best general insurance policy?

Amidst the various types of general insurance plans available in the market, you need to pick the right plans for the best coverage. To find the right general insurance policy, you should, first, assess the financial risks that you face and then choose the relevant plans that cover such risks. For example, the risk of medical contingencies is quite common and universally applicable to all. As such, a health insurance policy becomes a must. Similarly, if you own a vehicle, you would need to buy a third party motor insurance plan which is mandatory as per law.

Other insurance policies can be bought depending on your needs. For example, if you are travelling abroad and you want to cover your financial risks, an international travel insurance policy would help you with the same. If you are an organization, you should consider the different commercial insurance policies for securing your finances against unforeseen calamities.

After you have shortlisted the types of insurance plans that you would need, you should compare similar plans against one another to find a plan that offers the best coverage benefits at the lowest rate of premiums.

Coverage under general insurance plans

Different types of general insurance plans have different coverage benefits, depending on the financial risks that they cover. So, let’s have a look at some of the common types of general insurance plans and the coverage that they offer –

1. Health insurance

Health insurance plans come under two main variants. The first variant is the indemnity plan which covers the medical bills that are incurred when you are hospitalized. The second variant is the fixed benefit plan which pays a lump sum benefit if you suffer a medical contingency covered by the policy. Coverage of an indemnity health plan is quite comprehensive and includes the following benefits –

| Inpatient hospitalization | Inpatient hospitalization includes expenses incurred on room rent, treatment cost, nurse’s fees, ICU room rent, etc. if you are hospitalized for 24 hours or more |

| Ambulance cost | Expenses incurred for transporting the insured to the hospital in an ambulance for treatment. |

| Pre and post hospitalization | The expenses which are incurred before actual hospitalization, as well as the expenses incurred after being discharged from the hospital, are also covered. |

| Maternity | Some health plans also cover the maternity expenses incurred in case of childbirth. |

| AYUSH treatment | AYUSH treatments are non-allopathic treatments such as Ayurveda, Unani, Siddha and Homeopathy. Most of the health insurance plans cover the expenses incurred on such treatments. |

| Day Care treatment | Daycare treatments include treatments that do not require hospitalization for a minimum period of 24 hours due to advanced technology |

| Domiciliary treatment | The cost of treatment taken at home when the insured is not in a condition to be shifted to a hospital or because of the non-availability of hospital beds is called domiciliary treatment. These treatments are covered in many health insurance plans. |

| Organ Donor expenses | It includes the expenses incurred on harvesting an organ from an organ donor. |

| OPD coverage | OPD cover includes all the medical expenses incurred on an OPD basis as diagnosis test, investigative reports, doctor’s consultation and pharmacy expenses |

| Covid-19 | All health insurance plans also cover hospitalization due to COVID |

| Free health check-ups | Health insurance plans allow free preventive health check-ups after specified periods, i.e. once every 1-4 policy years |

| No claim bonus | If you do not make claims under health insurance plans, you get a no claim bonus. This bonus either allows an increase in the sum insured free of cost or a discount in the renewal premium. |

2. Motor insurance

Motor insurance plans cover the financial losses associated with cars, bikes and other commercial or private vehicles. The coverage offered by motor insurance plans are as follows –

| Third-party liability | Financial liabilities that are incurred if your vehicle causes physical injury, death or property damage to any third party are covered. A third party cover is mandated under the Motor Vehicles Act, 1988 and is a must for every vehicle |

| Natural calamities | Damages due to natural calamities such as storms, earthquakes, floods, hurricanes, etc. are covered |

| Man-made calamities | Damages suffered by the vehicle due to man-made disasters such as burglary, fire, self-explosion or ignition, riots, strikes, etc. are covered |

| Theft | In case the insured vehicle is stolen, a lump sum amount will be paid under the motor insurance policy to compensate the policyholder for the financial loss suffered |

| Accidental damages | Damages suffered when the vehicle is involved in an accident is covered under the motor insurance plan |

3. Travel insurance

Travel insurance plans cover financial losses that you might suffer while travelling. Travel plans provide coverage for the duration of your trip. Different types of insurance plans have different coverage benefits. However, there are some common coverage benefits under all travel plans which are called standard coverage benefits. These include the following:

| Medical emergency | If the insured falls sick while travelling or is hospitalized, the travel insurance policy will pay the cost and expenses of such hospitalisation as well as the medical bills. |

| Delay of checked-in baggage | In case of delay in receiving the checked-in bag, a claim would be paid by the insurance company to help you buy the items of personal use until your baggage is returned |

| Trip Cancellation | If your trip gets cancelled due to unavoidable circumstances or reasons, the expenses incurred in pre-booking the tickets and hotel accommodation would be reimbursed |

| Loss of passport | The travel insurance policy also covers the cost of arranging a duplicate passport if your passport gets lost on the trip |

| Mortal remains repatriation | The cost of repatriating the remains in case of death on the trip is covered |

| Loss of baggage | In case your baggage is misplaced by the airlines and is lost, the financial loss suffered would be covered |

| Accidental death or disability | A lump sum benefit will be paid under the policy in case the insured suffers accidental death or disability while on the trip or while travelling by air |

| Alliance for hijack distress | In the event of hijack of the flight by which the insured is travelling, the travel insurance policy pays a benefit for the distress suffered |

| Emergency cash advance | In case of loss of wallet or theft, a cash advance is offered so that you can meet the travel-related expenses. |

| Third-party liability | Loss to third parties due to your fault would be covered under travel insurance plans |

How much do general insurance policies cost?

The cost or the premium of general insurance companies is determined using different parameters. These parameters depend on the type of general insurance policy that you buy. Let’s have a look at the factors that determine the premium of the popular types of general insurance policies –

1. Health insurance premium

The cost of a health insurance policy depends on a lot of factors. The factors which affect the premiums of health insurance plans are discussed below:

| Age of the insured | Higher the age of the insured, higher will be the premium and vice versa. Hence, it is advisable to buy a health insurance policy at a young age |

| Sum insured in the plan | The higher the sum assured, the higher will be the premium. Sum assured is the maximum liability undertaken by the insurer in the event of a claim |

| Number of members covered in the plan and their age | A family floater health plan allows you to opt for a single policy for multiple family members. More the family members, higher will be the premium and vice versa |

| Claim history | Some Health Insurance providers allow a discount on the amount of renewal premium if you have not made a claim in the previous year. Others might load the premium based on your claim history |

| Applicable Discounts | Health insurance plans provide different premium discounts. These discounts reduce the amount of premium payable |

| Medical history and condition of the insured | Health risk increases in case of existing medical condition or in case of family history of any particular disease. This increase in health risk increases the chances of making a claim. Hence, health insurance premiums are higher for individuals with an adverse medical history |

| Add- ons selected | Optional coverage benefits are offered along with health insurance plans for enhanced protection. Each add-on involves an additional premium which increases the overall premium payable for the policy |

| Location | Health Insurers have classified Indian cities as Tier I, Tier II and Tier III cities as the medical expenses in different cities are different. Medical expenses in tier I cities which are metropolitan cities are higher than in tier II and tier III cities. As such, their corresponding premiums are also higher. |

2. Motor insurance premiums

The premiums of motor insurance plans differ across insurance companies and depend on various factors. Such factors are as follows –

| Insured Declared Value (IDV) | IDV represents the market value of the vehicle after depreciation. It is the sum insured of a motor insurance policy. The more expensive the vehicle, the higher will be the premium. |

| Age | The vehicle’s age determines the premium. Older the vehicle lower would be the premium and vice-versa |

| Type of motor Insurance plan | Third-party liability-only policies are cheaper than comprehensive insurance policies due to their limited coverage. |

| The make, model and variant of the vehicle | The make and model of your vehicle is one of the factors for the motor insurance premium. The premiums for vehicles like sports cars are generally higher than for lower or standard cars. |

| Geographical location | Premium calculation is divided into two zones in which Zone A represents metropolitan cities and Zone B covers the rest of India. Premiums for vehicles registered in Zone A are higher than those in Zone B |

| Discounts | Motor insurance plans offer different types of discount. The eligible discounts lower the premium |

| Add-on covers | The coverage of motor insurance policy can be enhanced through add-ons. These add-on covers come with an added premium cost which increases the total premium payable |

| Engine size | The engine size of the vehicle plays an important role in calculating the insurance premium. The larger the engine size higher the premium and vice versa |

| Purpose of the vehicle | If you intend to use your vehicle for commercial purposes, then the insurance company will charge a higher premium. However, if you purchase a vehicle for personal purposes, the premiums would be lower. |

| No claim discount | By making no claims under an existing motor insurance policy you can avail of discounts on the renewal premiums. This no claim discount, thus, reduces the premium payable |

3. Travel insurance premiums

There are certain factors that determine the cost of a travel insurance policy. These factors are mentioned below:

| Pre-existing medical conditions | If the policyholder has any pre-existing medical conditions then the premiums of the travel insurance policy will shoot up. |

| Duration of the travel | The longer the duration of the plan, the higher the premium will be and vice versa. |

| Age of insured travellers | Older travellers are more prone to illnesses and injuries. Hence, premiums increase with the age of the insured members |

| Number of members covered | The higher the number of members covered, the higher would be the premium |

| Travel destination | The farther and expensive the destination is, the higher the insurance premium. Also, in case the policyholder moves to a remote location or area with a certain risk, the insurance premium will be higher |

| Type of coverage | A comprehensive travel insurance policy costs a higher premium compared to a basic plan |

| Sum insured | The higher the sum insured in the plan, the higher will be the amount of premium and vice versa. |

| Adventure sports coverage | In case the plan covers adventure sports, the premiums would increase due to the higher risk involved. Higher the risk, the higher the premium. |

| Add-ons selected | Adding extensions to the policy would increase the premium because of the wider scope of coverage |

How to buy general insurance plans?

There are two modes of buying the different types of general insurance plans. They are as follows –

- Offline mode : You can get in touch with a general insurance agent and buy the policy that you need. Alternatively, you can visit the branch of an insurance company and apply for a suitable general insurance plan. You would have to fill up a physical application form, submit your documents and the premium amount while making a proposal for buying insurance. If the company accepts your proposal, the policy would be issued and you get the coverage.

- Online mode : The online mode is a more convenient way of buying general insurance plans. Almost every general insurance company offers its plans online and so, you can visit the website of the company, choose a policy and then buy the policy online.

Alternatively, you can choose aggregator websites like Turtlemint wherein you get the benefit of comparing across different insurance companies. You can visit www.turtlemint.com and select the type of general insurance policy that you want. Provide your details and compare the quotes of different insurers. Find a policy that provides the most suitable coverage benefits and comes at the best premium rate.

How to make a claim in your general insurance policy?

For making claims under general insurance policies you have to follow a specific claim process. Just like premiums, the claim process is also different for different types of general insurance plans. Let’s have a look at the claim process under the most popular types of general insurance plans –

Health insurance claim process

Health Insurance claims can be made in the event of hospitalization or any covered medical contingency. Health insurance claims can be made in two ways – cashless or reimbursement. Here is the process of both these claims:

- Cashless claim : Cashless claims can be settled in case of hospitalization only in the networked hospitals of the insurance company with which it has tied- up. Steps for making a cashless claim are as follows:

- Inform the insurance company by filing a pre-authorization form and submit it to the insurance company within 24 hours of emergency hospitalization. In case of planned hospitalization, submit the form at least 3-4 days before being hospitalized.

- The insurance company will assess the claim on the basis of the pre-authorization form and approve the cashless facility.

- Submit all the medical bills, documents and reports to the insurance company along with original document proofs of other hospitalisation expenses, if any, for settlement.

- Reimbursement claim : Reimbursement claims can be made if you are hospitalized in a hospital that is not tied up with the insurance company. For reimbursement claims, the following steps are needed for claim settlement:

- Inform the insurance company that you have been admitted to a non- tied up hospital.

- Retain all the original medical bills and reports of the hospital and avail a discharge summary or a discharge certificate from the hospital from which the treatment has been availed.

- Pay the hospital bill out of your pocket and submit all the documents and the bills to the insurance company

- The insurance company will assess the claim and expenses and reimburse the bills that you have paid.

Motor Insurance Claim Process

When your vehicle is stolen or is involved in an accident, you can make a motor insurance claim by following these steps:

- Inform the insurance company immediately. The company would guide you to the nearest networked garage.

- The company would send its surveyor to assess the damage and prepare a claim report

- Based on the surveyor’s report, the claim would be approved. You can, then, avail of cashless repairs.

- The repair bills would be settled by the company with the garage

- If, however, you get your vehicle repaired at a non-networked garage, you would have to pay the repair bills yourself. Then, file your claim with the insurance company and the company would reimburse you for the costs

- In case of third party claims, file a police FIR. The claim would be handled by the motor accidents tribunal. Once the tribunal specifies the claim amount, the insurance company would pay the amount to the third party

- In the case of theft, file a police FIR. If the police are unable to find your vehicle, they would issue a certificate certifying the same. Submit this certificate along with other claim-related documents and the claim would be paid.

Travel Insurance Claim Process

It is very simple and easy to make a claim in your travel insurance plan. The steps are discussed below:

- Inform the insurance company or the service provider immediately when you face a travel insurance claim. One should be handy with the claim helpline number of different Insurance companies to register the claim.

- After intimation, the insurance company will provide the details of the tied-up service providers in the country you are travelling to, to help you with the easy settlement.

- You can inform the service provider and submit the claim related documents to process your claim.

- The insurance company or the service provider will verify the documents and settle your travel Insurance claim.

So, understand general insurance and its types and then buy suitable plans depending on your financial needs.