A motor insurance policy is legally mandatory if you want to drive on Indian roads and not face penalties. The Motor Vehicles Act, 1988 mandates every vehicle plying on Indian roads to have a valid third party liability policy. The policy covers your financial liability if you are involved in a vehicular accident and harm any third party or property. Here’s a brief look at what the third party policy covers –

- Bodily injury or death of the third party arising out of an accident involving your vehicle

- Damage caused to any third party property because of your vehicle

In both these instances, you might be financially held liable for compensating the aggrieved third party for the damages caused. A third party liability policy covers this financial obligation and settles the compensation payable to third parties in case of any accidental injury or damage.

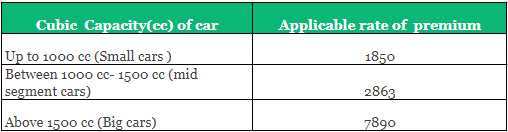

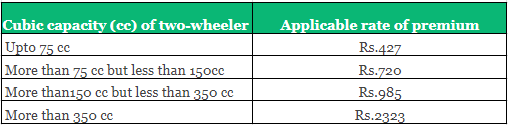

Given the nature of the third party policy, the policy was made mandatory. Since the policy is mandatory in nature, the premium is fixed by the Insurance Regulatory and Development Authority of India (IRDAI). IRDA is the apex governing body of the insurance sector and is entrusted with the task of fixing third party policy premiums. Third party premium rates depend on the cubic capacity of the motor vehicle. Ever since 2011, IRDA has been formulating and notifying the third party premium rates to general insurers offering motor insurance policies. These premium rates are, usually, modified every year and the changed rates are communicated to the concerned insurance companies. This year too, IRDA has made some changes in the third party premium rate and has issued new rates which are applicable from 1st April, 2018. Here are the new rates –

For private cars

For privately owned two-wheelers

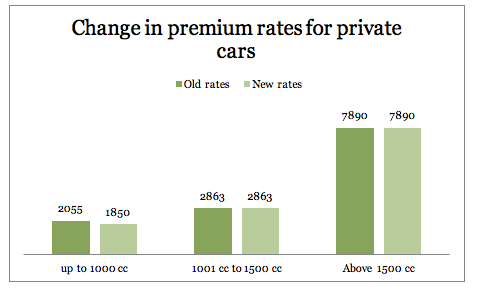

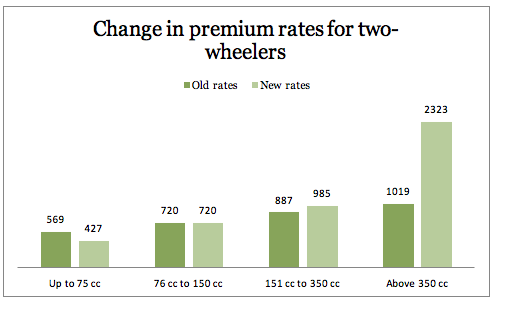

If you compare the older rates which were applicable in the year 2017-18, you would find that there have been some reductions in the new premium. For private cars and two-wheelers with a small engine capacity, the new premium is lower. However, for higher engine capacities in two-wheelers, the new premium has increased. Here’s a comparative analysis of the old v/s the new –

Small cars up to 1000 cc have seen a premium decrease of about 11%. Other than that, there has been no change in third party premiums for higher engine capacities.

For two-wheelers, there has been an only decrease in two-wheelers with limited engine capacities. No changes have been made to two-wheelers with engine capacity of 151 cc to 350 cc. Premium and luxury two-wheelers have seen an increase in premium. While vehicles with engine capacities of 151 cc to 350 cc have seen an increase of 11%, premium for luxury two-wheelers have been increased by more than 127%.

In case of commercial vehicles, taxi owners have a reason to rejoice. Third party premiums for taxis have come down by 15%. In case of three-wheeled autos the premiums have increased. Goods carrying vehicles like trucks and dumpsters have seen a premium increase of 10% to 25% while for smaller vehicles the premium rates have been kept same.

Though the premium for third party policy has changed, the change would be applicable from the coming financial year. Policies bought or renewed on or after 1st April, 2018 would reflect the changed premium rates. Existing policies would not be cancelled and reissued for affecting the change in premium.

The third party premium rates are changed every year. You should know about these changes whether you are buying a third party policy or a comprehensive one. After all, you should know how much premium are you paying for your motor insurance policy, should you not?

Visit our site Turtlemint.com to compare and buy your car or bike insurance.

Read more about Why you need third party insurance for two wheelers?

Read more about Is it worth buying third party car insurance policy?

Read more about All you need to know about car insurance

Read more about Everything you should know about two wheeler insurance policies in India

Check out our video below to understand why the premium of motor insurance has shot so high