Motor Insurance – Overview

Today, having your own vehicle and commuting using your own vehicle has become a necessity rather than a luxury. Short distance commute can be done easily by motorbikes and other two-wheelers whereas long-distance commute needs a four-wheeler. Travelling by a two-wheeler is advantageous in case of heavy traffic and it is also fun, especially for the younger generations; whereas commuting by a four-wheeler gives comfort.

However, several risk factors are associated when you are commuting either by motorbike or by a car on the Indian roads. So, it is necessary to ensure the protection of your vehicle against any such risk factors and this can be feasible by vehicle insurance or motor insurance.

Vehicle insurance or motor insurance is an agreement between the insurance provider and you for ensuring the protection of your vehicle in case of an unprecedented incident on the roads. Vehicle insurance is a mandate for all vehicles that are being used on the Indian roads. The main objective of vehicle insurance or motor insurance is to ensure the protection of your vehicle against any damage caused by natural or man-made calamities. With the recent amendments made to the Motor Vehicle Act, 2019 it has become extremely important to know about the different aspects associated with Motor Insurance.

Importance and benefits of buying a vehicle insurance policy:

So, why do you need motor insurance or vehicle insurance? Let us find out the major reasons and benefits of having vehicle insurance.

- Reduces liabilitiesThird-party liability insurance coverage is mandatory in India. In case of an accident caused by you, the third-party liability insurance will cover all the expenses incurred in the treatment or repair of the third party person or vehicle.

- Payment for damagesThe cost incurred in repairing vehicles i.e. a car or a motorbike is always high. There might be accidents and your vehicle will need repairs. In such a case, if you have vehicle insurance you will not have to pay the expenses from your pocket.

- Hospitalization expensesSome road accidents can be major incidents and can cause serious injuries. The treatment and hospitalization expenses incurred can be too high. If you have vehicle insurance or motor insurance and you have chosen the medical expenses add-on, you do not need to worry about these expenses and can focus on your treatment.

- Compensation for your familyThere can be some very serious road accidents in which the owner of the vehicle passes away. This would be a matter of financial emergency for the family members of the demised person. By vehicle insurance, the insurance provider can provide compensation to the family of the demised person.

- Online vehicleinsuranceWhen you buy online vehicle insurance, then it is usually cheaper as there is no commission that needs to be paid to the distributors.

- Reduced stress levelVehicle insurance will reduce your levels of stress and you would be able to enjoy peace of mind.

Also Read: How to Check Vehicle Insurance Policy Status Online?

Reasons to buy motor insurance with a number of road accidents

The deteriorating condition of the Indian roads, increase in the number of vehicles on the roads and the negligent attitude of the young drivers towards traffic rules are the major reasons for the increase in the number of accidents in India.

Due to these reasons, many insurance providers in India have included several benefits along with the motor insurance policy. Facilities like cashless claims at garages which are included in the network of the insurance company, towing facility, roadside assistance, invoice protection cover, accident cover; consumables cover, etc. are being offered as add-ons to vehicle owners for ensuring all-round protection of their vehicle.

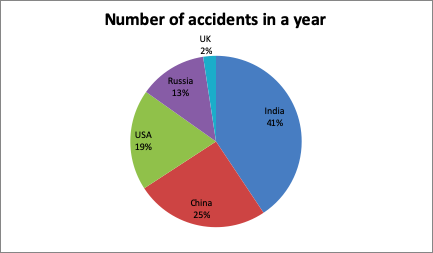

According to a global report on the statistics of road accidents by WHO,

- The number of road accidents in India was 129,965.

- The number of road accidents in China was 80,500.

- The number of road accidents in the USA was 60,780.

- The number of road accidents in Russia was 40,890.

- The number of road accidents in the UK was 7689.

This data, when represented in the form of a pie-chart, shows that the highest percentage of road accidents occur in India. The need for road safety awareness and vehicle insurance is most required in India.

Different Types of Motor Insurance Policies in India:

Here is a list of different types of motorinsurance policies that are available in India:

- Third-Party Vehicle Insurance PolicyThird-party vehicle insurance policy is mandated by the Government of India to ply the vehicles on the Indian roads as per the Motor Vehicles Act, 1988. A third-party liability only insurance policy provides coverage for the damages and the loss that has been incurred by a third-party person, property or vehicle by your vehicle.This is an insurance policy which saves the owner from all legal liabilities in case of an accident. The insurer bears the expenses arising out of the eventuality as long as the owner has a valid third-party motor insurance policy at the time of the accident.A third-party vehicle insurance policy covers any damage done to a third person’s property or vehicle or any bodily injury to a third-person resulting in death, disability or dismemberment or any legal liabilities arising from the same towards the owner.

- Comprehensive Vehicle Insurance PolicyA comprehensive motor insurance policy provides for complete protection of the vehicle towards damages done for own vehicle along with third-party coverage. This complete coverage includes any damage that has been caused to the car which is insured, any third-party liabilities and personal accidents.The different types of comprehensive vehicle insurance policies are:

- Private Car InsurancePrivate Car insurance Policies will cover any damages caused to your own car or a third-party car because of accidents occurred. To obtain a good car insurance policy, you should compare car insurance policies online and select the best one.

- Two-wheeler InsuranceTwo-wheeler insurance provides coverage for any damages caused to scooters or motorbikes and its riders during accidents. It also covers any damage caused to two-wheelers due to natural calamities or man-made disasters like theft, riots, etc. Generally, there are two types of two-wheeler insurance policy i.e. Comprehensive two-wheeler insurance policy and liability-only two-wheeler insurance policy.

- Commercial Vehicle InsuranceThose vehicles which are used for business purposes are known as Commercial vehicles. Commercial vehicle insurance is available for vehicles such as buses, taxis, ambulances and other vehicles like shovels, tractors, etc. By commercial vehicle insurance, coverage is provided by the insurance provider for damage caused to the vehicle due to accidents.

- Long term vehicle insurance policyA long term vehicle insurance policy is one that provides coverage for more than a year. In the case of two-wheeler insurance plans, long term comprehensive coverage is available for two or three continuous years. For car insurance plans, however, long term comprehensive coverage is not available.Moreover, for new vehicles, long term third party liability coverage is a must. This coverage should be availed as follows –

- For new two-wheelers, long term third party liability cover for 5 years is mandatory

- For new cars, long term third party liability cover for 3 years is mandatory

- Bundled vehicle insurance policyA bundled vehicle insurance policy is one that offers long term third party insurance coverage and annual comprehensive coverage. This type of policy is available for new vehicles. The different types of bundled plans available in the market are as follows –

- Bundled two wheeler insurance plans wherein the third party coverage is offered for 5 years and own damage coverage is offered for 1 year

- Bundled car insurance plans wherein the third party coverage is offered for 3 years and own damage coverage is offered for 1 year

- Pay-as-you-drive motor insurance plansLaunched under the Sandbox initiative of the IRDAI, pay-as-you-drive motor insurance plans are flexible policies that allow you to insure your vehicle only when you use it. Coverage is allowed for both third party and own damage liabilities. Premium depends on the usage of the vehicle that you declare when buying the plan. Since the coverage is usage based, the premiums are quite low. Presently, only a handful of insurance companies are offering this type of policy.

Inclusions of Motor Insurance Plans in India:

Let us know about the damages which are covered under motor insurance or vehicle insurance.

- Any damage caused to the vehicle due to natural calamities like earthquakes, storms, cyclones, floods, lightning, landslide, etc. are covered

- Any damage caused to the insured vehicle due to man-made calamities like fire, self-explosion, riots, malicious acts, strikes, etc. are covered

- The loss or theft of the vehicle that has been insured is covered under vehicle insurance.

- Any third party liabilities incurred by the third party person or vehicle during an accident is covered under vehicle insurance. Such liabilities might arise if any third party is physically injured, killed or if any third party property is damaged by the insured vehicle.

- Damages suffered when the vehicle is being transported from one location to another through air, water, or land.

- Vehicle insurance also offers personal accident cover for the insured vehicle’s driver/owner. This coverage allows additional benefits payable in the case of accidental death or permanent disablement. The sum insured is INR 15 lakhs. The personal accident cover, however, is not mandatory. If you have an existing personal accident cover independently or with another policy, you can skip this cover. If, however, you are not insured under any personal accident cover, you need to buy the coverage offered by vehicle insurance plans.

Exclusions of Motor Insurance Plans in India:

The below-mentioned damages caused to a vehicle are not covered under vehicle or motor insurance.

- Any damage caused to a vehicle due to the effect of alcohol or drugs on the driver.

- Damage caused to the vehicle due to wear and tear or ageing of the vehicle.

- Any damage caused to the vehicle being driven by a driver without a valid driving license.

- Any electrical or mechanical breakdown of the vehicle.

- Any damage caused to the vehicle outside the boundary of India.

- Damages suffered when the policy has lapsed

- Self-inflicted or deliberate damages

- Consequential losses

- Damages due to war, mutiny or nuclear perils

- Damages suffered when engaging in a criminal or hazardous act

List of the most common add-on covers in comprehensive motor insurance:

There are several add-on plans which can be included in your motor insurance policy to enhance the coverage provided. Some of these add-on covers can be mentioned below.

- Zero depreciation coverIn the case of a claim, depreciation suffered by the parts of the car is not covered. The insurance company deducts the depreciation charges and then settles the claim. This results in out-of-pocket expenses for the policyholder and reduces the claim amount. However, when a policyholder opts for this add-on, the effect of depreciation is negated. The full value of the repaired or replaced parts is paid as claim.

- Key replacement coverIn case of a key being lost, the policyholder will be eligible to claim reimbursement for the cost of the substitute key.

- Roadside assistance coverRoadside assistance cover helps in assisting at remote locations in case of issues like flat tires, fuel issues, battery problems, etc. If your vehicle breaks down in the middle of a remote location, you can call the insurer’s helpline number, 24*7, and get any type of assistance that you need.

- NCB protect coverIn case of no claims made by a policyholder during a policy term, the policyholder is rewarded with a no claim bonus. The bonus starts from 20% and can increase up to 50% if you don’t make a claim in successive policy years. You can use the accumulated bonus to claim a premium discount at the time of renewals. However, if there is even a single claim under the policy, the entire no claim bonus is lost. The NCB protect cover protects the accumulated no claim bonus even when you make a claim.

- Engine protection coverBy the engine protection cover, if there is any damage caused to the vehicle’s engine, due to water seepage, then the repair or replacement cost will be covered by the insurance provider.

- Return to invoice coverIf your vehicle is completely damaged or if it is stolen, the insurance company would pay the invoice value of the vehicle as claim if you choose this add-on.

- Personal accident cover for passengersThrough this add-on you can extend the personal accident cover for the passengers travelling with you in the vehicle. If the passengers suffer accidental death or disablements, the cover would pay a lump sum benefit.

- Consumables coverThis add-on covers the cost of consumables used at the time of repairs which is otherwise excluded from coverage.

- Medical expenses coverIf you choose this add-on and you are hospitalized following an accident in the vehicle, the medical costs incurred on treating your injuries would be covered.

- Loss of personal belongings coverUnder this add-on the loss or theft of personal belongings from the vehicle is covered. The insurance company reimburses you for the loss suffered.

Different plans offered with features and coverage

As there are several insurance providers providing various motorinsurance policies in India, let us list down the major ones.

- Tata AIG Motor Insurance PolicySome of the motorinsurance plans offered by Tata AIG are mentioned below.

- Auto Secure Two-wheeler package policy

- Long Term Two-wheeler package policy<

- Auto Secure –Private car package policy

- Auto Secure commercial vehicle package policy

The major features of the motorinsurance plans offered by Tata AIG are as follows.

- Personal accident covers for owner and driver

- Coverage against third party liabilities

- Coverage against loss or damage caused to the insured vehicle by any natural or manmade calamities.

- Inclusion of several add-ons for providing comprehensive coverage to policyholders.

- Reliance General Motor Insurance PolicyReliance Insurance provides various plans related to motor insurance such as two-wheeler insurance policy, Private Car Insurance policy, Commercial vehicle insurance policy, etc. The major features associated with Reliance motor insurance policy are as follows.

- Coverage against damage caused to the vehicle due to natural calamities like fire, lightning, flood, earthquake, flood, cyclone, etc.

- Coverage against damage caused to the vehicle due to manmade calamities like theft, riots, strikes, terrorism, malicious activities, etc.

- Instant purchase of policy online without any hassle and paperwork.

- Cashless access to garages that are covered under the network of Reliance India Co. Limited.

- Motorinsurance renewal can be done online without any paperwork.

- 24×7 roadside assistance add-on covers for the policyholders.

- Discount up to 70% on insurance premium for both car insurance and two-wheeler insurance policies.

- Very quick claim settlement for the policyholders.

- HDFC Ergo General Motor Insurance PolicyHDFC Ergo is one of the popular motorinsurance providers in India. Some of the car insurance policies offered by HDFC Ergo are Long Term comprehensive car insurance, Third-party liability car insurance, Single year comprehensive car insurance, Long term comprehensive two-wheeler insurance plan, Two-wheeler liability only insurance, Standalone motor own damage cover-two- wheeler, etc.

- HDFC Ergo vehicle insurance policy provides coverage against accidental damages, thefts, and other manmade calamities.

- Coverage against third-party liabilities incurred for both i.e. person and vehicle.

- HDFC Ergo vehicleinsurance policy provides personal accident cover.

- Add-ons coverage such as NCB cover, Engine protects cover, Key replacement cover, Emergency assistance cover, return to invoice cover, etc.

- Customer support is available always 24×7 for efficient query resolution of customers.

- Paperless and boundless work procedure.

- Bajaj Allianz General Motor Insurance PolicyBajaj Allianz offers vehicle insurance policies for two-wheelers, four-wheelers, commercial vehicles, etc. The major features and benefits offered by Bajaj Allianz’s vehicle insurance policies are mentioned below.

- Instant online insurance policy purchase and renewal.

- Policyholders can avail NCB cover for around 20%-50% discount on insurance premiums.

- 24×7 customer support to assist in claim settlement and other issues related to the motorinsurancepolicy.

- Cashless claims can be made at garages that come under the network of Bajaj Allianz.

- Several add-ons, emergency assistance cover, and good quality services.

- Royal Sundaram Motor Insurance PolicyRoyal Sundaram is a popular name in the motor insurance market of India. Vehicleinsurance policies such as two-wheeler insurance policy, commercial vehicle insurance, car insurance, etc. are some of the eminent insurance policies offered by Royal Sundaram.

- Coverage against natural calamities like a landslide, floods, fire, terrorism, etc.

- Coverage against accidents and other manmade calamities like terrorism, theft, burglary, malicious acts, etc.

- Personal accident cover is provided to the policyholders.

- Coverage for any third-party liabilities incurred.

- Cashless claims in network garages

Parameters that help decide the premium:

Certain eminent parameters which help in determining the premium of your vehicle insurance are mentioned below.

- Make, Model and age of the VehicleThe premium of the vehicle depends on the make, model and the age of the vehicle. The premium for motor insurance policy varies from one vehicle to another depending on the make of the vehicle. Since the models of vehicles are different from each other, the insurance premium is also different.Even petrol and diesel variants of the same vehicle have different insurance premiums.

- IDVThe Insured Declared Value or the IDV is the market value of a vehicle adjusted with the vehicle’s age-based depreciation. The IDV also represents the maximum claim liability of the insurance company in the case of own damage claim. The insurance premium is, therefore, high for those vehicles which have a higher IDV.

- Geographic locationThe insurance premium for vehicles belonging to those locations is higher where there are more risks associated with natural and man-made calamities. Similarly, if your vehicle is registered in a metro city, the premium would be higher compared to those in non-metro cities.

- Add-ons selectedAdditional covers increase the scope of coverage of the motor insurance plan. So, if you opt for add-ons, your vehicle insurance premium would increase.

- Type of policyThird party plans have lower premiums because of the limited scope of coverage that they offer. On the other hand, comprehensive vehicle insurance plans offer a wider scope of coverage and charge a higher amount of premium.

- Age of the vehicleOlder vehicles have reduced values and so their premiums are also lower compared to newer ones.

- Claim historyIf you are renewing an existing motor insurance policy, the claim history would also affect the premium. If you have not made claims in the previous years, you can claim a no claim discount that would reduce the premium amount. On the other hand, if claims had been made, the no claim discount would not be available and the premiums would be higher.

- Discounts availableMotor insurance plans allow different types of premium discounts. If you can avail of the discounts, the premiums would be lowered.

How to reduce the premium for a motor insurance policy?

Let us have a look at some of the easy methods to reduce the premium for a motor insurance policy.

- Installing anti-theft devices in vehiclesBy installing anti-theft devices in your vehicle, you are reducing the chances of theft of your vehicle. As your vehicle is not exposed to the risk of theft, your insurance provider will charge a lower premium from you.

- No claim bonus (NCB)There are several discount options available on the premium of vehicle insurance. When you have a good claim history and you are selecting a comprehensive motor insurance policy, you obtain a maximum of 50% no-claim bonus (NCB) which helps you to reduce your premium.Tip: Do not claim for smaller claims, but save your NCB so that your overall premium would reduce.

- DeductiblesYou can also choose to opt for the voluntary deductible as it will decrease your premium amount for a motor insurance policy.

- Opting for riders carefullyYou should be wise while selecting your riders for the vehicle insurance. You should only choose those riders which will be helpful to you actually rather than selecting any random rider.

- Compare policy onlineYou should compare vehicle insurance policies offered by different insurance providers online to have an idea of the benefits offered by different policies and the premium prices.

- Membership of AAI or WIAAIf you are having a membership in AAI (Automobile Association of Upper India) or WIAA (Western India Automobile Association), you will have an opportunity to avail discount on vehicle insurance premiums.

Benefits of comparing policy online:

Some of the major benefits of comparing vehicle insurance online are mentioned below.

- By comparing vehicle insurance online or motor insurance online, you get to know in detail about the features and benefits offered by the motor insurance policy. You can also know about the various add-ons and the coverage provided by the policies. This makes easier for you to select the best vehicle insurance providing maximum coverage.

- A comparison of motor insurance online helps you to know in detail about the claim settlement ratio of various insurance providers. You can compare the claim settlement ratio of various insurance providers and select the one with the highest ratio for yourself.

- When you compare motor insurance online, you can have knowledge about the benefits offered by different insurance providers and the premium they charge. Depending on your requirements, you can select the policy which provides maximum coverage at a reasonable premium.

- If you are comparing motor insurance online, you become aware of the various discounts offered by insurance providers. These discounts are quite helpful as they help in premium reduction.

How to compare policy online?

In order to compare a vehicle insurance policy online, you need to follow the following steps:

- Log on tohttps://www.turtlemint.com/

- Click on the “car” tab to compare car insurance policies online and on the “bike” tab to compare two-wheeler insurance policies online

- For renewing old vehicles, put in the car number to find plans or you can also click on “Continue without Car number”

- With car number:

- Your car’s make, model and petrol/diesel variant are extrapolated from the motor vehicles registration details

- You need to select the exact variant of the vehicle and then click “next”

- Then select “expiry date” of the insurance policy

- Then select the previous type of policy from comprehensive and third-party

- Last year claim history, in order to determine NCB

- And finally, mention the last policy NCB and the insurer’s name and then click “next”

- Then fill in your name and contact details then click “next” or you could “skip for now” as well

- Then you have the list of plans from which you could choose from

- Continue without Car number:

- Fill in the registration location

- Then choose from renewing your policy or buying a new policy

- Fill in the details of your vehicle’sMake and model

- The year of manufacturing

- Fuel type- petrol/diesel

- Vehicle variant

And then click on “next”

- Then fill in your name and contact details then click “next” or you could “skip for now” as well

- Then you have the list of plans from which you could choose from

How to file a motor claim with a list of documents required?

For filing a motor claim, it is necessary to follow the claim process so that claim is settled easily and at the earliest. The process, thus, is as follows –

- Inform the insurance company immediately after a claim. The insurer would register your claim, provide the claim reference number and also inform you about the nearest networked garages for getting cashless repairs

- If your vehicle has suffered any damage, take it to the nearest preferred garage for cashless benefit

- The insurer’s surveyor would visit the garage and assess the damages

- The surveyor would prepare a claim estimate and submit it to the insurer

- Based on the surveyor’s estimate, cashless approval would be given by the insurer

- Once the approval is received, the garage would repair the vehicle and the bills would be settled directly by the insurer

- If, however, you choose a non-networked garage for repairs, you would have to pay for the repair costs out of your pockets. After the vehicle is repaired, file a claim with the insurer and the company would reimburse you for the expenses incurred

- In the case of third party claims, file a police FIR. The motor accidents tribunal would assess the claim and announce the liability. The insurer would settle the claim directly with the third party

- In the case of theft of the vehicle, file a police FIR. If the police are unable to trace your vehicle, they would issue a non0traceable certificate. Submit this certificate to the insurer along with other claim documents for claim settlement

Certain documents related to vehicle insurance details that need to be submitted for processing the motor claim are as follows.

- Driving License of the driver

- Registration Certificate Book

- Police Report

- Final bill obtained from the repairers

- A fitness certificate in case of commercial vehicles

Frequently Asked Questions:

- How can you calculate the motor insurance premium?Motor insurance premium can be calculated by using a good motor insurance premium calculator. This is easily available on the websites of insurance aggregators and can be used for premium calculation.

- Can motor insurance renewal be done online?Yes, motor insurance renewal can be done online by logging in to the website of your respective insurance provider.

- What is IDV?IDV is defined as an Insured’s Declared Value and is referred to as your vehicle’s current market value. The IDV of your vehicle is an important factor in determining your vehicle insurance premium.

- Is third party liability insurance policy mandatory?Yes, third party liability insurance policy is mandatory in India.