There is a big ‘if’ in the word ‘Life’ itself. The word ‘if’ represents all the challenges that life throws at you. Life is uncertain and the best way to deal with these uncertainties is to be prepared against them. One such uncertainty is death. While death is inevitable, premature death is uncertain and if it happens, it creates emotional as well as financial loss. While emotional loss cannot be compensated against, financial loss can be. This is where life insurance comes into the picture. Life insurance policies are designed to cover the risk of premature death. If the insured dies during the term of the policy, life insurance plans pay a death benefit. However, life insurance is a broad concept which cannot be summed up in the above two lines. So, let’s understand life insurance definition in details.

Table of Contents

What is life insurance?

Life insurance is a policy which covers the risk of premature death. If, during the term of the policy, the life insured dies, the policy promises to pay a death benefit. Life insurance policies are legal contracts where, against the coverage offered by the insurance company, you are supposed to pay a premium for availing the coverage. Moreover, besides premature death, many life insurance plans also cover survival to the end of the policy tenure wherein a maturity benefit is paid.

Top 5 features of life insurance plans

Some of the salient features of life insurance policies are as follows –

- The individual whose life is covered under the policy is called the life insured or life assured

- The individual who pays the premium for the policy is called the policyholder

- The policyholder and the life insured can be same or different. When you buy a life insurance policy on your life, you are the policyholder and life insured. However, when you buy a policy on the life of your spouse or dependent child, you would be the policyholder but the life insured would be the spouse of the dependent child

- Every life insurance policy has a specified duration and coverage level which you can choose

- There are different types of life insurance plans and each plan has a different benefit structure

Importance of life insurance plans:

Here are the reasons why life insurance plans are important –

- Life insurance policies provide financial security. They promise to give your family financial assistance in case of your premature death

- There are different types of life insurance plans and each plan helps you in fulfilling your life’s financial goals

- By investing in life insurance policies you can buy peace of mind for yourself as far are financial stability is concerned

- Life insurance policies also give you tax benefits and help in lowering your tax liabilityGiven these benefits of life insurance plans, you should invest in a suitable policy.

Different types of life insurance policies

As stated earlier, life insurance plans come in different variants. Let’s understand these variants and their respective features-

Term Insurance

Term insurance is the most basic type of life insurance policy. The policy promises death benefit during the term of the plan. On maturity, usually, nothing is paid. Term plans are the cheapest form of life insurance which gives you unmatched financial protection.

Salient features of term insurance

- Term plans allow high coverage levels at a low cost

- Coverage can be taken for very long durations going up to 30 or 35 years or till 85 years of age. Different plans have different options available

There are different types of term plans which are as follows:

- Increasing term plans where the sum assured increases every year

- Decreasing term plans where the sum assured reduces every year

- Level term plans where the sum assured does not change

- TROP or Term Plan with Return of premium option where the premiums paid are returned if the plan matures

Whole Life Insurance

Whole life plans, as the name suggests, run for your whole life and allow coverage till you reach 99 or 100 years. These plans are like term insurance plans but with indefinite coverage duration.

Salient features of whole life insurance plans

- Coverage is allowed till 99 or 100 years of age

- Different types of whole life plans are available in the market. You can buy endowment oriented plans, money back whole life plans, pure protection plans or even unit linked plans

- Premiums under whole life plans are payable for a limited period

- Under endowment oriented, money back or unit linked plans, there is also a maturity benefit if you survive till 99 or 100 years of age

Endowment Assurance

Endowment plans are traditional savings-oriented life insurance plans. These plans provide coverage against premature death. Moreover, on maturity, a guaranteed maturity benefit is also promised. Endowment plans, therefore, promise insurance as well as savings.

Salient features of endowment assurance plans

- Endowment assurance plans are a combination of insurance as well as investment options

- Coverage duration can range from 10 years to up to 30 years

- The plan usually offers guaranteed benefits on death or maturity at 99 years of age

- The plan can be a participating or a non-participating plan.

- Participating plans earn bonus

- Non-participating plans do not earn bonus

5. Guaranteed additions or loyalty additions are also promised under many endowment assurance plans

Money Back Plan

Money back plans are also called anticipated endowment plans because they are like endowment plans but with anticipated benefits. Under these plans, the sum assured is paid in instalments at specified durations over the policy tenure. This allows liquidity while at the same time providing life insurance notes coverage.

Salient features of money back plans

- The money back benefits are called survival benefits

- Money back plans are offered as participating plans where bonuses are added

- In case of death of the insured, the entire amount of sum assured is paid irrespective of the survival benefits already paid earlier

- The tenure of a money-back plan often ranges from 12 or 15 years till 20 or 25 years.

Unit Linked Insurance Plans

Unit linked insurance plans are unique life insurance plans which provide the double benefit of insurance as well as investment returns. Premiums paid for these plans are invested in market linked funds. This fund then grows as per the performance of the market. If the insured dies during the policy tenure, a death benefit is paid. On maturity, the fund value is paid which is equal to the premiums invested along with the returns that they earned over the term of the policy.

Salient features of unit linked plans

- There are different types of investment funds suitable for different risk appetites

- You can choose the premium that you want to pay, the investment fund and the duration of the plan

- Partial withdrawals are allowed after the completion of 5 policy years wherein you can withdraw from the fund

- Switching is allowed for changing the selected investment fund

- Many unit linked plans also allow additional premiums through top-ups

- Higher of the sum assured or the fund value is paid on death. On maturity, however, the fund value is paid

Child Plan

Child insurance plans are life insurance plans which are created to secure your child’s future. Under these plans, there is an inbuilt premium waiver rider. This rider waives the premiums in case of death of the parent who is also the policyholder. Though the premiums are waived, the policy continues and pays a benefit after the end of the term when the child needs it for higher education or marriage. Child insurance plans, therefore, ensure a corpus for the child’s future whether the parent is alive or not.

Salient features of child insurance plans

- Child plans can be traditional endowment or money back plans or unit linked plans

- Only parents of minor children can buy the policy

- The life insured can be parents or the minor child. The policyholder, however, would always be the parent

- When the child attains 18 years, he/she becomes the policyholder. The policy, then, vests in the child’s name

- If the parent is the life insured, in case of death during the term, a death benefit is immediately paid. The plan, however, continues to run and the insurance company pays the premiums. Thereafter, on maturity, a maturity benefit is paid again

Health Plan

Life insurance companies also offer health insurance policies. These policies either cover specific illnesses or a list of critical illnesses. If the insured suffers from the illnesses covered by the plan, a lump sum benefit is paid as per the policy’s benefit structure.

Salient features of health plans

- The plans are offered for a period of 5 years to 30 years

- The plans pay a lump sum benefit irrespective of the medical costs incurred

- Heart related illnesses, cancer and other critical illnesses are some of the commonly covered illnesses under health plans

Annuity

Annuity plans or pension plans are retirement oriented life insurance plans. Under these plans you can either create a retirement corpus or avail lifelong incomes from an already accumulated corpus. Pension plans help you plan for your financial needs post retirement.

Salient features of pension plans

- There are two types of pension plans – deferred annuity plans and immediate annuity plans

- Under deferred annuity plans you can choose a policy tenure and pay premiums to build up a retirement corpus

- Under immediate annuity plans annuity payments commence immediately after you buy the plan

- Under deferred annuity plans, 1/3rd of the accumulated corpus can be withdrawn in cash through commutation. The remaining would then be used to avail annuities

Life Insurance Riders

Besides the above-mentioned types of life insurance plans, there are riders too which are additional coverage benefits. Riders are available with almost all types of life insurance plans (except health and immediate annuity plans). You can choose any rider as per your coverage needs by paying an additional premium.

Salient features of life insurance riders

- Riders have their own sum assured which can be equal to or lower than the sum assured of the base policy

- You can choose multiple riders

- Each rider comes with an additional premium

- Riders do not have any maturity benefit. They cover a specific contingency and pay a benefit only if that contingency occurs

Types of life insurance riders

Life insurance riders can be offered in the following types –

| Type of rider | Meaning |

| Accidental death and disablement benefit rider | This rider pays an additional sum assured if the insured dies or becomes permanently disabled due to an accident |

| Critical illness rider | This rider covers a list of critical illnesses. If the insured suffers from any of the covered illnesses during the term of the policy, the rider pays a lump sum benefit |

| Premium waiver rider | This rider waives the premiums payable under the policy if the insured becomes disabled |

| Hospital cash rider | This rider pays a daily cash allowance if the insured is hospitalized for 24 hours or more |

| Term rider | This rider pays an additional sum assured if the insured dies during the policy tenure |

What is life insurance claim?

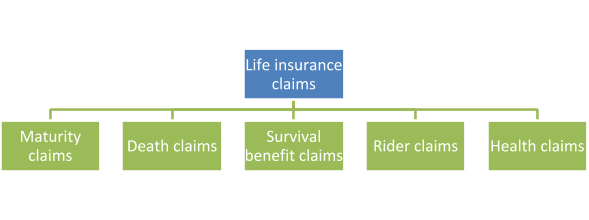

Now that you have understood life insurance meaning and the different types of life insurance policies, let’s understand claims. It is important to understand what is life insurance claim so that you can understand the benefits that you receive from different plans. Life insurance claims are of different types which can be understood below –

Here’s a brief description of each type of claim –

| Type of claim | Meaning | Who gets the claim? |

| Maturity claim | This claim is paid when the policy completes the chosen term and the life insured is alive at the end of the term. Maturity claims are initiated by the life insurance company itself as the policy approaches maturity | The claim is paid to the policyholder |

| Death claim | If the life insured dies during the term of the plan, the claim that is paid is called a death claim. Death claims would be paid when the insurance company is intimated about the death of the insured | Death claims are paid to the nominee appointed by the life insured |

| Survival benefit claims | These claims are paid under money back policies. Under these claims a part of the sum assured is paid as money back benefit if the life insured is alive at the time of payment of the money back benefit | The claim is paid to the policyholder |

| Rider claims | If the contingency which was covered by a rider happens, a rider claim is paid | The claim can be paid to the policyholder or the nominee depending upon the type of rider |

| Health claims | If the insured suffers from an illness which was covered under the health insurance plan, a health claim is paid | The claim is paid to the policyholder |

Life insurance companies in India and their claim settlement ratios

In India, there are 24 life insurance companies operating in the market. Apart from LIC, which is owned by the Government of India, all other insurers are privately owned companies.

Life insurance companies are often judged by their claim settlement ratios. The ratio denotes the number of claims paid by the life insurance company against the total claims made upon it in a financial year. It is calculated as a percentage and published by the Insurance Regulatory and Development Authority of India (IRDAI) every year. The higher the ratio, the better the company is perceived to be since it can be trusted to settle its claims. You can, therefore, choose a life insurance company based on its claim settlement ratio among other things.

Here is a complete list of life insurance companies currently operating in India along with their published Claim Settlement Ratios for the financial year 2017-18 –

| Name of the life insurer | Claim Settlement Ratio |

| Life Insurance Corporation of India | 98.04% |

| HDFC Life Insurance Company Limited | 97.80% |

| Axis Max Life Insurance Company Limited | 98.26% |

| ICICI Prudential Life Insurance Company Limited | 97.88% |

| Kotak Mahindra Life Insurance Company Limited | 93.72% |

| Aditya Birla SunLife Insurance Company Limited | 96.38% |

| TATA AIA Life Insurance Company Limited | 98% |

| SBI Life Insurance Company Limited | 96.76% |

| Exide Life Insurance Company Limited | 96.81% |

| Bajaj Allianz Life Insurance Company Limited | 92.04% |

| PNB MetLife India Insurance Company Limited | 91.12% |

| Reliance Nippon Life Insurance Company Limited | 95.17% |

| Aviva Life Insurance Company Limited | 94.45% |

| Sahara India Life Insurance Company Limited | 82.74% |

| Shriram Life Insurance Company Limited | 80.23% |

| Bharti AXA Life Insurance Company Limited | 96.85% |

| Future Generali India Life Insurance Company Limited | 93.11% |

| IDBI Federal Life Insurance Company Limited | 91.99% |

| Canara HSBC OBC Life Insurance Company Limited | 95.22% |

| Aegon Life Insurance Company Limited | 95.67% |

| DHFL Pramerica Life Insurance Company Limited | 96.62% |

| Star Union Dai-ichi Life Insurance Company Limited | 92.26% |

| IndiaFirst Life Insurance Company Limited | 89.83% |

| Edelweiss Tokio Life Insurance Company Limited | 95.25% |

Tax implication of life insurance policies

When talking about the benefits of life insurance policies, their tax efficiency was highlighted. Let’s understand how life insurance plans can help you save tax –

Tax benefits on premiums paid

The premiums that you pay for your life insurance plans (except annuity plans and health insurance plans) are allowed as a deduction from your taxable income under Section 80C. As per the provisions of this Section, you can claim a deduction of up to INR 1.5 lakhs by paying premiums of your life insurance policies. The premiums paid for annuity plans also qualify as a deduction but under a different Section. Pension plan premiums are allowed as a deduction under Section 80CCC of the Income Tax Act. The limit under this Section is also up to INR 1.5 lakhs but it also includes the deductions under Section 80C. Thus, you can claim a maximum deduction of up to INR 1.5 lakhs aggregately from life insurance premiums as well as pension plan premiums under Section 80C and Section 80CCC respectively. For health insurance policies, the deduction is allowed under Section 80D. You can claim a maximum deduction of up to INR 25,000 by investing in health insurance plans. If you are a senior citizen, you can enjoy a higher deduction as the limit increases to INR 50,000. Moreover, if you buy a health insurance plan for your dependent parents, you can claim an additional deduction. This deduction would be up to INR 25,000 if your parents are below 60 years of age and INR 50,000 if they are senior citizens. Thus, Section 80D offers you a maximum deduction of up to INR 1 lakh.

Tax benefits on claims

The claims received under life insurance policies are completely tax-free under Section 10(10D) of the Income Tax Act. Whatever be the type of claim that you receive, the entire amount would be allowed as a tax-free income without a maximum limit.

Tax benefit on commuted pension

In case of deferred annuity plans, 1/3rd of the corpus which you withdraw as cash is called the commuted pension. This commuted pension is completely tax-free in your hands under Section 10(10A) of the Income Tax Act.

Tax implication of annuities

The annuity payments that you receive from life insurance pension plans are considered to be an income in your hands. This income is taxable and would be subject to tax at your prevailing income tax slab rates.

How to buy life insurance plans?

Having understood life insurance meaning and its importance, it is imperative that you buy a life insurance policy for your financial needs. To buy the policy, you have two options which are as follows –

- Buy offline

- Buy online Buying offline means buying the policy from a life insurance agent or by visiting the insurance company’s branches. It is time consuming and involves unnecessary hassles. The easier way to buy life insurance plans is online. The online platform allows you to buy life insurance policies easily and quickly. Turtlemint is one such online platform wherein you can buy the best life insurance policy for your requirements.

The benefits of buying online from Turtlemint are as follows –

- You get to compare the insurance plans offered by leading life insurance companies. You can, therefore, choose the best policy in respect of coverage and premium rates

- Turtlemint gives you personalized assistance in case you have any queries about any life insurance policy before you buy. You can, therefore, clear your doubts and know exactly what the policy promises

- Even in the case of claims you can contact Turtlemint’s team and they help you in getting your claims settled quickly and easily

Given these benefits, buying from Turtlemint is a wise choice.

To buy a life insurance policy, you need to fill up a proposal form and submit your relevant documents. The documents needed to buy a life insurance policy include the following –

- Photographs of the life insured and the policyholder (if different from one another)

- Identity proof

- Address proof

- Age proof

- Income related documents if you are paying a high premium and opting for a high sum assured

- Medical reports, if required

- Any other document as required by the insurance company

When these documents are submitted, the life insurance company verifies the information you mentioned in the proposal form. If everything is found to be correct, the life insurance policy is issued.

A life insurance policy proves to be a financial weapon in the face of contingencies. While you cannot avoid the challenges life throws your way, you can definitely insure the risks that you face. Life insurance plans promise coverage of your life risk and help you create a safe financial net for your loved ones. So, invest in a life insurance policy and secure your family’s happiness.