How secure are you with your regular health insurance plan?

Your regular health insurance policy may not be enough to cover your future medical expenses. With rising costs of quality healthcare, the coverage provided by your policy may fall short and you may be forced to dig into your personal savings. You may choose to buy another regular policy, but that is expensive.

How can you increase your health coverage without the need to buy an additional policy?

The super top-up plan is the answer!

A super top-up plan provides you additional health cover at a fraction of what you will pay if you buy another health policy. A super top-up plan comes into picture when you’ve exhausted your claims up to a threshold limit. And this works even when you exhaust your threshold limit after combining the costs of multiple treatments in a year. Let’s understand it with an example.

Suppose you have a super top-up plan of INR 10 lakhs with a threshold limit of INR 5 lakhs, which you can claim through a regular health policy.

Scenario 1: You are hospitalized and your medical expenses are INR 3 lakhs.

You can claim 3 lakhs from your regular health plan.

Scenario 2: You are hospitalized again, in the same year, and your medical expenses are INR 5 lakhs.

You can now claim only 2 lakhs from your regular health plan. The super top-up plan will cover the remaining 3 lakhs now.

Also read how to lower your insurance premiums

Sounds perfect, right? Now let’s look at all the advantages of buying a super top-up plan.

Why should you opt for a Super Top-Up Plan?

- In the last 10 years, the costs for medical treatment have increased by more than 50%. The cover provided by basic health plans may not be sufficient. Super top-up plans help to deal with the growing medical costs and inflation.

- You don’t need to have an existing health policy to buy a super top-up plan. You can pay up to your threshold limit out of your own pocket and then use the super top-up plan, to pay for the rest of the expenses.

- A super top up gives more cover to the existing policy, especially with growing health needs of the family with kids and dependent parents.

- Covers multiple treatments and considers the total of all medical bills in a policy year for the threshold limit.

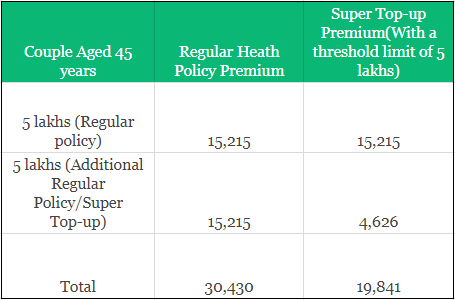

- Buying super top-up plan is much economical as compared to regular health plans, if you want to upgrade your health cover. For example, if a couple aged 45 years, have an existing health policy of Rs. 5 lakhs, and they want to increase the cover to Rs. 10 lakhs, then a super top-up plan with a threshold limit of Rs. 5 lakhs will work out to be around 35% cheaper than another health policy of Rs. 5 lakhs as per the following table:

- You can purchase a super top-up plan from a different insurer than your current one. The claims process is easier though, with a single insurer.

- Additionally, a super top-up plan:

- Is available as both individual and family floater policies.

- Is eligible for tax deduction under Section 80D.

- Allows cashless treatment at insurer’s network of hospitals.

- Requires no medical check-up till the age of 55yrs, for pre-acceptance.

Super top-up plan is therefore, the best way to cover all your medical expenses during the year, that too at a lower premium. Buying a health policy, however, should depend on the coverage provided keeping in view the inflation in costs of medical treatment. If you need to compare and understand the benefits of a variety of good super top-up plans, you may refer to these plans by visiting the health insurance page on our site.

Read more about Separate health insurance plans for parents or floater?

Read also An anatomy of an health insurance plan

Check out our video to understand what is a top-up and a super top-up?