Are you confused with the word tax? And “tax saving instruments” and sections etc. Here I try to simplify all terms that about the most relevant easy, safe instruments for you to invest and just be relaxed about your money.

Here are 8 financial instruments which you can invest immediately online through the click of a button.

1) Provident Fund

Provident Fund has been the preferred savings instrument for people for many years. Perks such as minimal risk, guaranteed return, and ease of contribution makes it one of the most commonly used tools to earn returns as well as save tax. There are multiple variations such as Public Provident Fund (PPF), Employee Provident Fund (EPF) and Voluntary Provident Fund (VPF) that one can choose from. The last two categories are applicable for salaried individuals. Another point which makes it a favorable option (when compared to bank deposits) is that the interest earned is exempt from tax.

Tax Benefit for investment in Provident Fund: up to INR 1,50,000 p.a. is tax-free U/S 80C

Maturity Amount: is also completely tax-free.

How to track your EPF investment online through UAN:

- You need to visit the EPFO official website

- Click on the “Know your UAN status” tab

- Fill in your details like the EPF number or your member ID, if you have along with your basic details like Name, Registered Phone Number, Email ID, Date of Birth, etc.

- The OTP would be sent to your registered mobile number for login

- Once you under the OTP, the UAN details would be emailed to your registered email id

- Then you can check your EPF details online with the UAN no.

2) National Pension Scheme (NPS)

In recent years, NPS has emerged as the dark horse amongst all the tax saving schemes. The changes in government regulations have made it a more lucrative and profitable option for investors. NPS subscribers can claim a tax deduction of 10% of their gross income. Additionally, an extra deduction of Rs. 50,000 is offered for NPS (Tier 1) account. This benefit is over and above the Rs. 1.5 Lakhs limit under Section 80C. In the last five years, the average return has been around 10.8% for NPS investors.

Taxation: Tax Benefit is given to Tier I Account and not to the Tier II Account.

Tax Benefit: Total INR 2 lakhs p.a.

- Up to INR 1,50,000 p.a. is tax-free U/S 80CCD(1) and

- Additional Tax Benefit of INR 50,000 p.a. U/S 80CCD(1B), over and above INR 1.5 lakhs of 80C for individuals contributing towards NPS

Maturity Amount:

- 40% of the entire corpus can be withdrawn tax-free at vesting when the annuitant is 60 years old,

- 40% of the corpus needs to be used to buy the annuity from a PFRDA listed insurance company (an annuity is taxed as per slab) and

- The remaining 20% of the corpus can be used to buy an annuity or withdraw as a lump sum and taxed as per slab.

3) Traditional Life Insurance

Most of us equate life insurance with peace of mind and savings. However, there is a third underlying benefit associated with these policies: How to save tax? Section 80C allows tax deduction for premium paid for self, spouse and children’s policy. The only condition is that the sum assured should be at least 10 times the value of one premium installment.

Tax Benefit:

The premium till INR 1,50,000 p.a. is tax-free U/S 80C.

4)Unit Linked Insurance Plans:

Who says you can’t have your cake and eat it too. ULIPs are a classic example. They have combined two great benefits – insurance and wealth appreciation. Investors have the flexibility to move between equity and debt as per their preference. From a tax standpoint, the premium paid and the maturity proceeds are exempt from taxation.

Tax Benefit:

The premium till INR 1,50,000 p.a. is tax-free U/S 80C.

Maturity Amount:

The maturity amount is tax-free U/S 10(10)D provided sum assured is at least 10 times the premium.

5)Equity Linked Savings Scheme

ELSS is a great choice for investors with a long-term focus. What makes it more lucrative (apart from the attraction of high returns) is the fact they help the investors how to save tax and provide an option to opt for growth or dividend as per their preference. Just remember that ELSS investments are high-risk investments as its invested in equity markets but should be looked at from the long-term perspective and it will give you high returns.The online tax calculators provide a return on investment for your ELSS schemes for a better understanding.

Tax Benefit:

The investment till INR 1,50,000 p.a. is tax-free U/S 80C.

Maturity Amount:

The maturity amount is taxed at a flat rate of 10% for capital gains of more than INR 1 lakh p.a.

6)Sukanya Samriddhi Yojna (SSY)

With this initiative from the government, there are double reasons to celebrate when you are blessed with a girl child. Started under the “Beti Bachao, Beti Padhao” campaign, this scheme enables parents to start a deposit scheme for the child. Investment in this scheme helps you how to save income tax under 80C. Additionally, the maturity proceeds are also exempt from tax. Currently, the scheme offers 8.5% interest per year. Also, as per the government rules, the SSY interest rate will always be maintained higher than what is offered by PPF.

Tax Benefit:

The investment till INR 1,50,000 p.a. is tax-free U/S 80C. The interest that compounds annually is tax-free.

Maturity Amount:

The maturity proceeds are completely tax-free.

7)Fixed Deposits with banks

These deposits come with a lock-in period of five years. Though the returns are not as high as some of the other options, they provide benefits such as ease of operation, digital banking, etc. There are some online tax calculators which provide an estimate on the return on investment for tax saving bank FDs.

Tax Benefit:

The investment till INR 1,50,000 p.a. is tax-free U/S 80C.

Maturity Amount:

The interest is tax-free till INR 10,000 p.a. in FY 2018-19 and till INR 40,000 from FY 2019-20 U/S 80TTA. The interest more than the 80TTA limit is taxed as per slab.

8)Medical Insurance

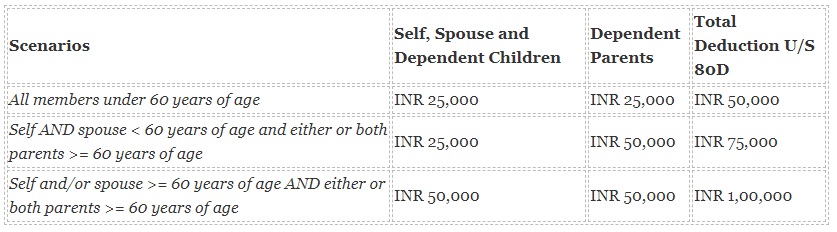

Health insurance as a concept has still not penetrated in the Indian market. As per a study was done by the National Health Profile in 2017, only 27% of people in the country had opted for health cover. However, with the increasing medical costs and a sea of lifestyle diseases plaguing us these days, it is a must-have for each individual. And what makes it a win-win proposition is the tax savings that one can enjoy with the schemes. Under Section 80D, individuals can claim the tax deduction for medical cover premium. It can be for self and family members (spouse, kids and parents). The benefit is capped at INR 25,000 (if age is less than 60 years) and INR 50,000 for senior citizens.

Tax Benefit: The health insurance premium is tax-free U/S 80D till a specified limit.

Maturity Amount:

Not applicable as there is no maturity amount is health insurance plans.

So, whatever is your risk appetite and financial goal, there is something out there for you to invest your money and save tax. Go make your choice.

Click on a video to know the facts about tax saving products:

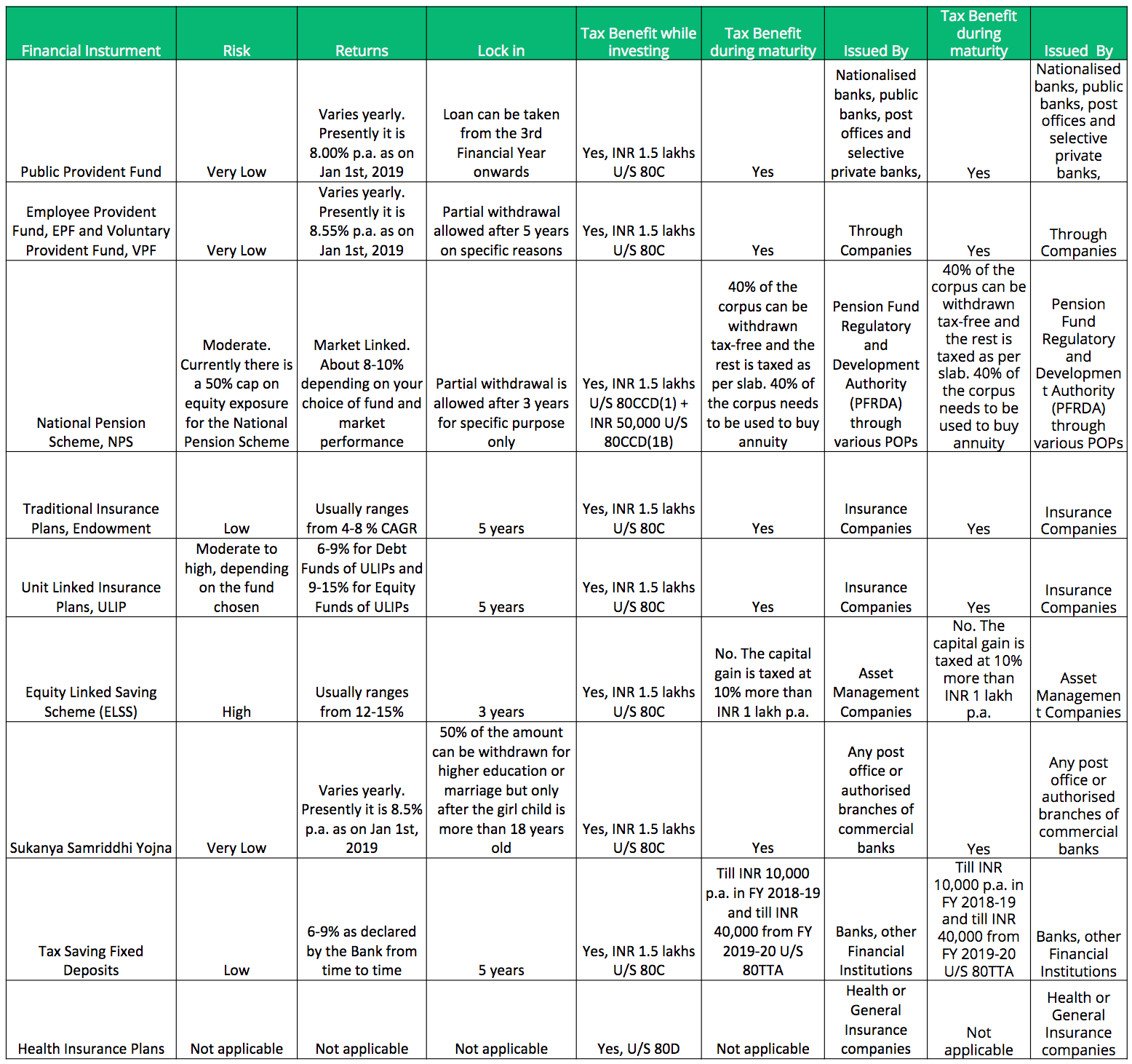

Below is a table giving a summary of all the benefits of Tax savings instrument

Read also How impactful has the interim budget 2019 been on your income and investments

Read also Complete guide on how term insurance policy can help you save tax