Buying car insurance enables one to hedge the risks that may arise due to damage or accident. It could be a very expensive affair to pay for an accident or damage out of your pocket. Car insurance is often considered complex as the terminologies may be tough to comprehend. By understanding these terms, we can gain deeper insight into car insurance premiums and claims. Read on to know why you need to consider car type before availing of a motor insurance policy!

Why is car classification critical for insurance policy premiums?

Car type is the primary factor for determining IDV (Insured Declared Value). IDV is the market value of the car, it is assessed at the time of extending the car insurance. The assessment is made by the insurer, based on the market value, the premium is decided. The IDV is based on the car classification which is in turn based on engine capacity. Within the car classification, the insurer typically looks at the engine capacity and car’s body type whilst determining the premium of car insurance.

In much simpler terms, IDV can be understood as the sum assured amount against your car insurance policy. Any claims that you raise due to any damage to your vehicle will be against this sum assured. The insurer will decide the appropriate claim amount to be paid out with IDV as the reference point.

What is the classification of cars?

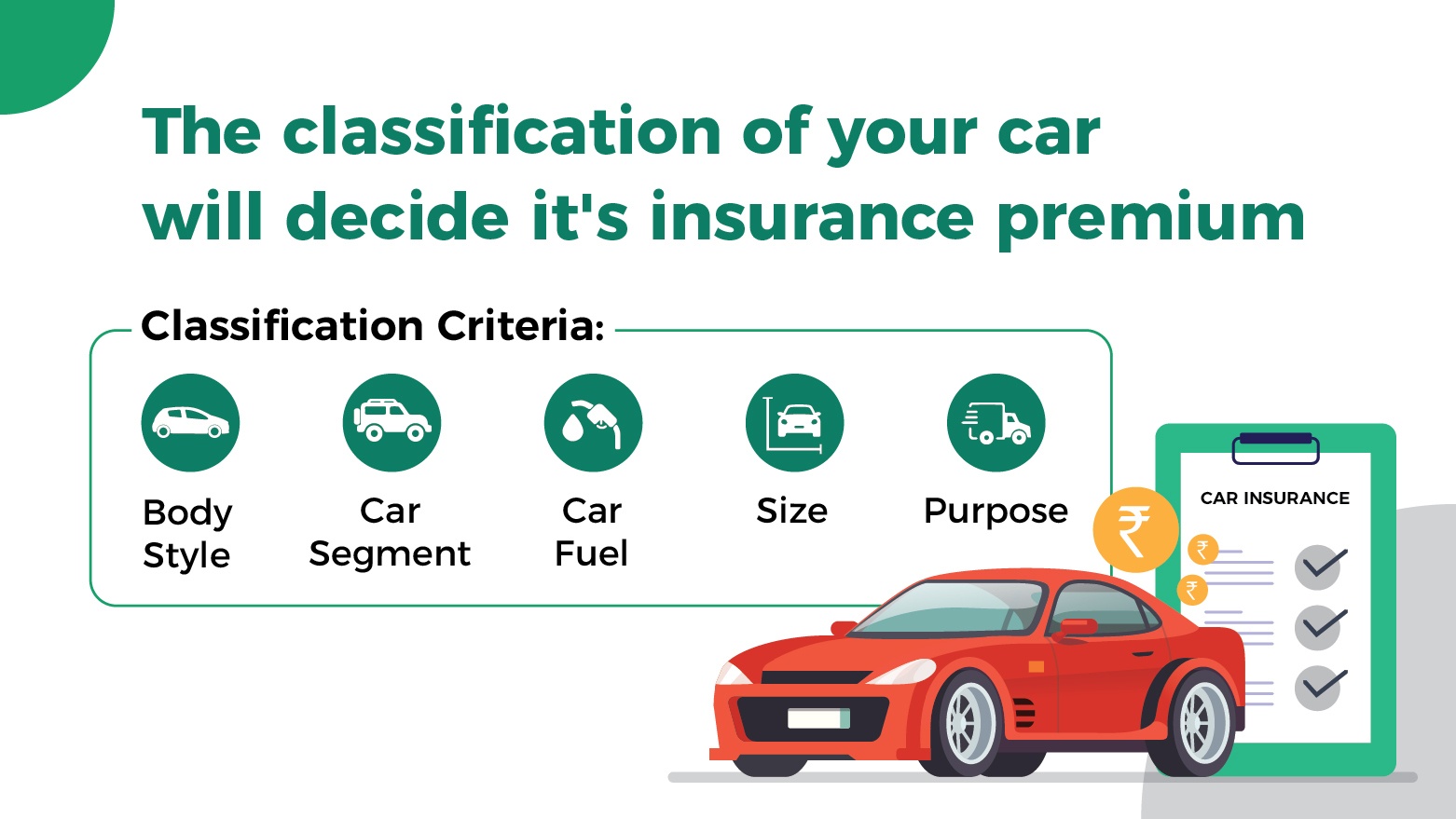

Now, there are various ways to classify cars. It could be based on body style, segment, fuel type, size of the vehicle, or purpose.

Cars can be classified as per:

- Body Style as a hatchback, sedan, crossover, vans, convertibles, etc.

- Car Segment as compact cars, luxury cars, sports cars, utility vehicles, mid-size or full-size cars, etc.

- Car Fuel as diesel, petrol, CNG, hybrid, etc.

- Size as micro, compact, sub-compact, mid-size or full-size cars, etc.

- Purpose as commercial, personal, sports, or luxury

Now, even with the classification, the insurance premium gets affected on the third party premium cost and the own damage premium cost independently. Let us understand how each portion of the premium is affected.

-

-

The effect of car classification on Third-Party Premium component of insurance:

Third-party insurance is a legally required part of car insurance. Third-party insurance compensates for the losses/expenses incurred by the other party with whom you have had an accident. The Motor Accident Claims Tribunal is obligated to compensate the victim in the event of an accident through the third–party insurance claim. By this means, the victim is compensated for any expense (vehicle-related or hospitalization) incurred, the vehicle owner is not burdened in this process.

Depending on the engine size, a third-party insurance policy is bifurcated across 3 price brackets. While the insurance premium itself will vary minutely based on other factors such as model number, past claims, etc. The broad categorization gives us the idea of the quantum of premium payable for third-party insurance.

Engine capacity Premium cost Less than 1000 cc Low premium More than 1000 cc – less than 1500 cc Moderate premium More than 1500 cc High premium

-

-

-

The effect of car classification on Own-Damage Premium component of insurance:

Many factors determine the insurance premium on your car insurance policy, one of the primary aspects is the type of your car. The car body indicates the strength of the car itself to sustain during an unforeseen incident. This is one of the primary factors which determines the premium payable on your car insurance premium.

Some of the common factors related to this aspect are –

- Hatchback or sedan?

It has been observed that car insurance premiums of hatchbacks are cheaper to insure due to their small size and large sales volume. On the contrary, sedans cost more than a hatchback, however, the segment into which they fall will be determined by the actual on-road price of the car, and the premium is decided accordingly. - High-end hatch-back and sedans:

Car insurance premiums for high-end hatchbacks and sedans vary from that of the normal hatchbacks and sedans due to the higher on-road price applicable to these cars. This is although hatchbacks, even the high-end ones have a small car body. - SUVs and MUVs:

Utility vehicles have been classified as Small or Midsize Utility Vehicles, SUVs, and MUVs. SUVs. / MUVs and other people carrier vehicles are usually more expensive to insure. These cars have a rugged build and are built for rough use, hence the possibility of damage is quite high. Also, the expenses for damage repair can be quite substantial.Also, SUVs and MUVs are used for off-road driving, and hence chances of damage are higher and hence the cost of repair is estimated to be higher than city vehicles. - Sports Cars:

Sports SUVs, luxury SUVs, sports sedans, supercars fall into the category with the most expensive premiums due to the complex build of the cars and the expensive technology embedded into these cars. These segments of a car are almost always insured/renewed on time to ensure that there is minimal out-of-pocket expense since the repairs can be quite expensive in these categories. - Luxury Vehicles:

Luxury vehicles have a completely different calculation for insurance, over and above the segment in which they fall due to the additional accessories that are usually attached to them.

- Hatchback or sedan?

-

Remember to consider the car insurance premium as well while purchasing a car. Getting your IDV assessed correctly is critical for availing of the right car insurance policy. The IDV is determined by your car type. While it may seem like a chore to avail yourself of car insurance, it is worth every penny especially if you are caught in the middle of any unfortunate accident leading to damage on either side.